Both leads and sales rebounded in January, heralding a positive start to 2024 despite the wider market appearing sluggish.

Before we pulled off the data from Business Pilot this month for the Barometer, we had a chat in the office about how we thought the first month had gone, and we were all surprisingly upbeat.

‘Surprisingly’ because many of the discussions in the trade press and online had been downbeat. For example: inflation is still too high, Bank of England interest rate isn’t coming down quick enough, the cost of energy is still fluctuating wildly, global supply chains are in trouble now there is fighting in the Red Sea.

These sentiments were accompanied by published reports that said that some parts of the UK construction industry struggled in the second half of 2023.

None of that is wrong, and we have to weigh all of those factors (and more) into our decision-making process.

The reason why we were more upbeat in the office was because despite the negativity, we knew things were beginning to look up after positive conversations we’d had with window companies – including those who do use Business Pilot, and those who don’t.

We could see the picture was more positive than the news would have us believe, but being the sticklers for data that we are, we waited for the figures to be published before making up our minds.

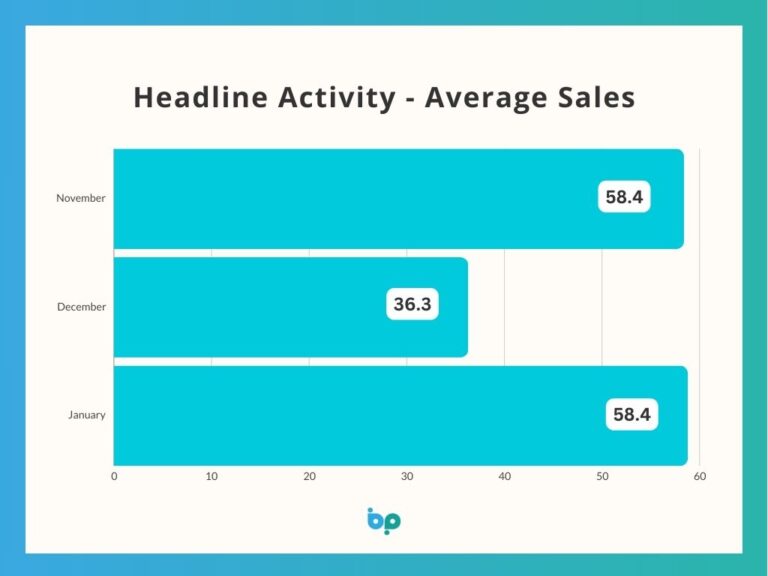

Sure enough, average sales were 58.4 – back up to what it was in November 2023. Not only that but they were 43.4% higher than a year previously, and 42.4% higher than the same period in 2022.

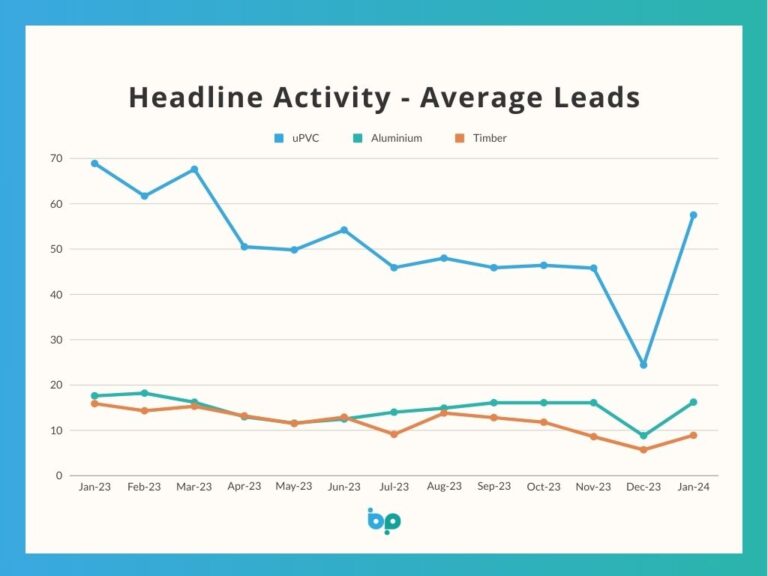

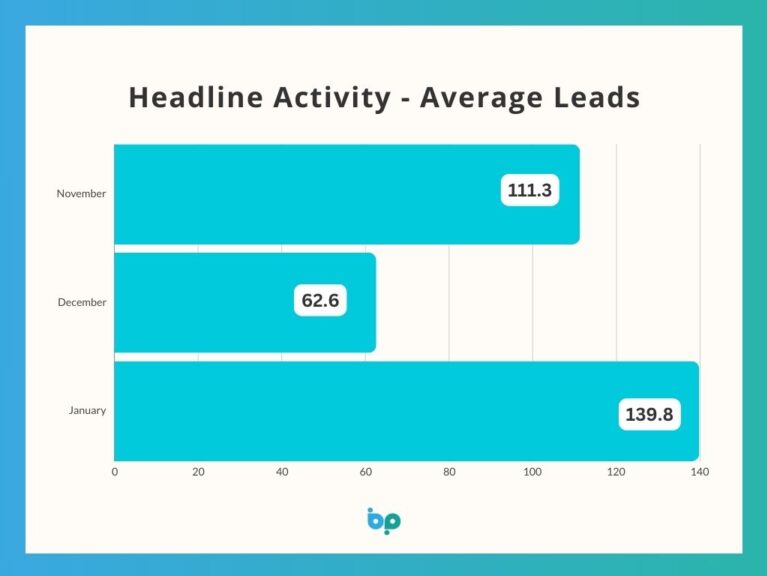

And when it comes to leads, the brakes have been removed. At an average of 139.8, the average leads were 25.6% higher than November 2023 (ignoring the typically quiet month of December) and 23.2% higher than the same period a year ago.

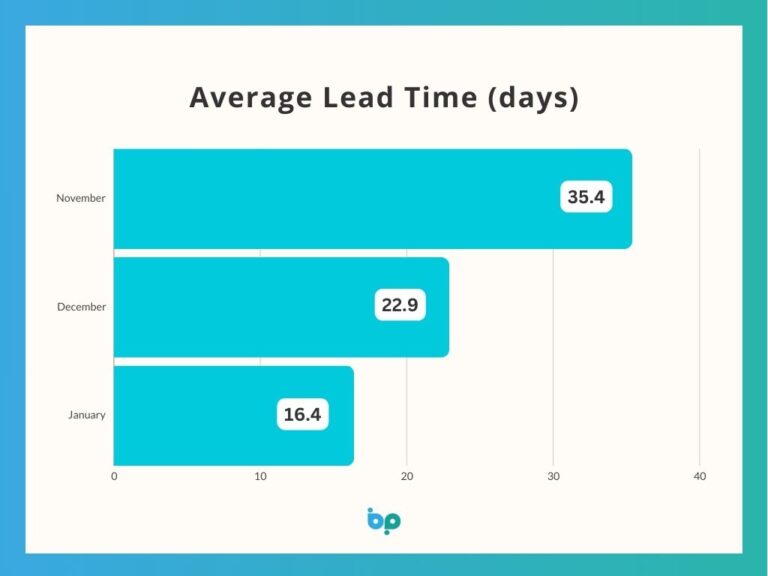

It is also worth noting that average lead times had dropped significantly to 16.4 days, which is 53.7% quicker than November 2023 (an average of 35.4 days) suggesting that homeowners have started 2024 with a determination to carry out home improvements and are making their minds up quickly.

This is supported by recent reports that the house market is picking up, which has accompanied a 0.7% rise in average house prices and a continued fall in mortgage rates.

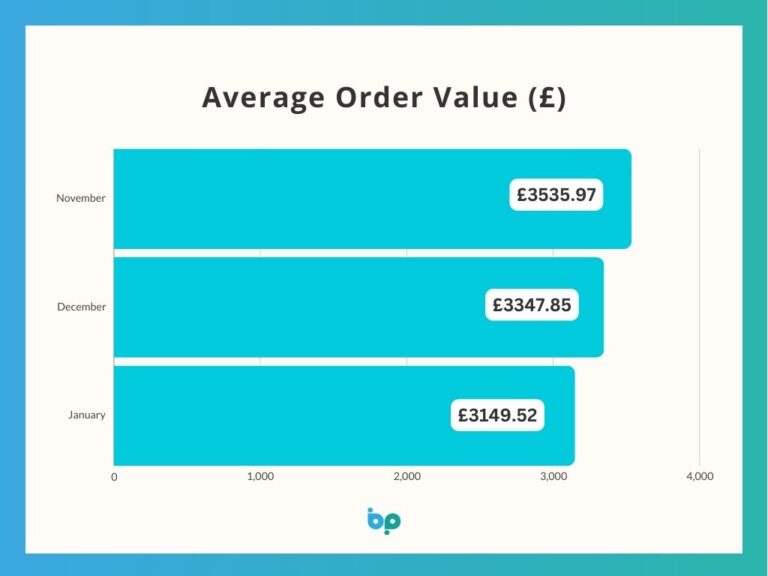

Interestingly, the biggest bounce back in leads by material type by some margin was PVC-U. Coupled with a slight fall in average order value to £3,150 (down 5.9% in December 2023), this suggests that the volume end of the market is partly responsible for the increased activity.