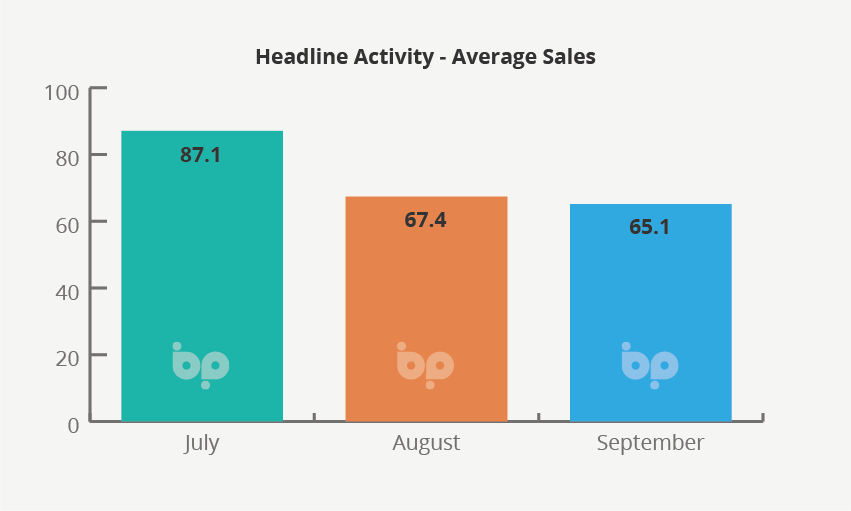

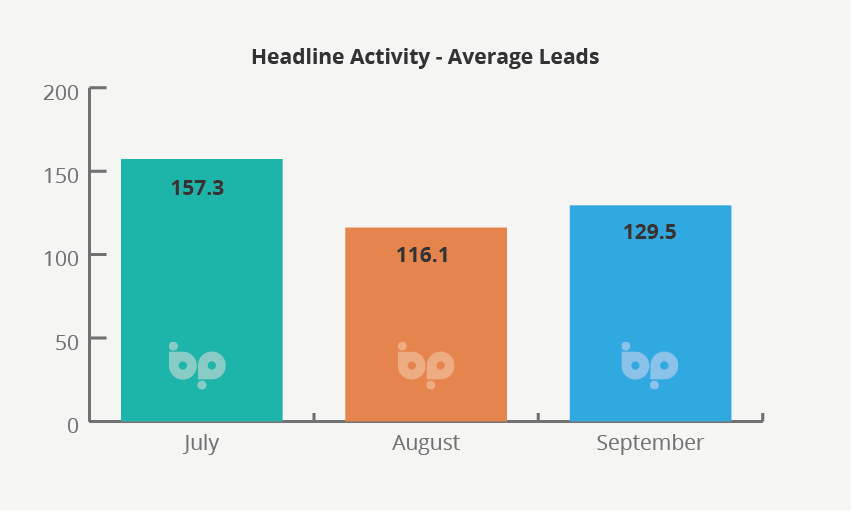

The market for windows and doors remains buoyant. This is clearly evidenced by the high levels of demand seen into September. As reported last month, however, there is a suggestion that going into the start of autumn things again slowed a little on summer.

This included a small drop in sales of around 3% on figures for August in September. This follows the 23% drop in sales in August on July.

It allows us to pinpoint June and July as the peak months for new orders with average leads up 70% June on May – and a staggering 453% on April. Sales were up 46% on May and almost 560% on April.

This can be directly attributed to the build-up of demand through lockdown in April and its release in May.

That, however, shifted over the summer, as the Chancellor attempted to breathe new life into the housing market with the introduction of the Stamp Duty holiday in July.

This meant that while many homeowners continued to ‘improve’, others redirected their efforts to moving. This contributed to a peak in activity in the housing market in August, something which we’d argue took a little heat, short term, out of the home improvement sector.

Figures published this month [October], suggest that the housing transactions have since slowed. An analysis by Pantheon Macroeconomics shows that visits to the three main property websites, Rightmove, Zoopla and On the Market, for example, trended down throughout September and are currently seven per cent below the peak on August 23.

Pantheon is forecasting that this would contribute to a peak in house prices this month [October] of around 3% on pre-COVID levels, with gains dropping off by 3% by early next year.

What does this mean for the window and door industry?

While returned deposits for cancelled holidays contributed to the exponential growth in demand seen for new windows and doors, it was underpinned by a fundamental confidence in the housing market. This should according to analysts for the most part, remain intact into 2021.

We would also argue over the coming months the industry will also directly benefit from the explosion in housing transactions seen in July, when the highest number of properties came onto the market since March 2008 – a 60% increase on the same period las year (Rightmove).

It may be another couple of months before these transactions are completed but this would suggest installers will see fresh demand come the start of the New Year.

It is also worth noting that the number of new leads also grew in September – up on average by almost 12%. The prospect of a second and localised lockdowns, the slowdown in the housing market and the desire to hunker down for winter, making up multiple drivers of demand.

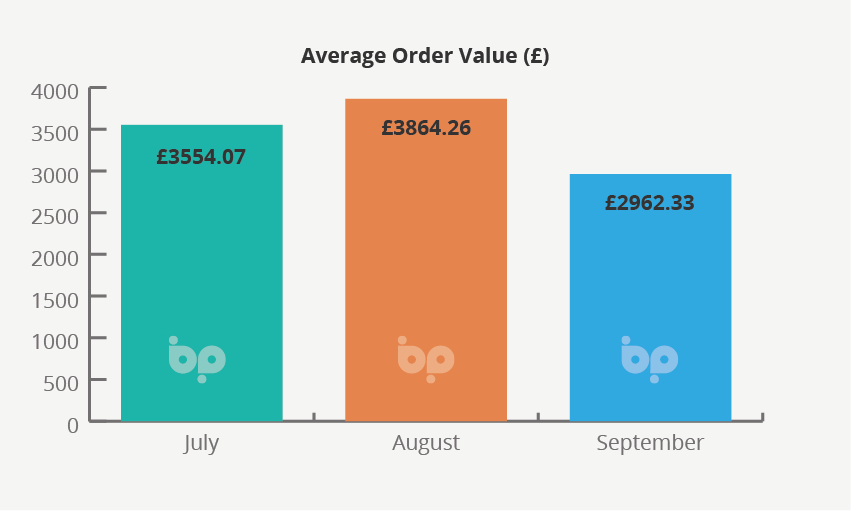

It is worth noting that average installed prices did, however, drop by 23% on August (£3,864 to £2,962). This could, we suggest be attributed to an increase in purchases of individual products and in particular, seasonal demand for bi-folding doors.

We’d argue that the bigger challenge for installers remains stability and the reliability of their supply chains. A number of very high-profile fabricators and glass companies have collapsed in the last few months, which coupled with exponential growth in demand makes the upward management of your supply chain key.

Giving you full visibility on the status of your orders and the flexibility to reschedule jobs and communicate those changes to your customers seamlessly, Business Pilot is here to help