May’s numbers tell an encouraging story. While activity has eased slightly in some areas, we’re seeing some positive shifts in others – especially where it matters most: conversion.

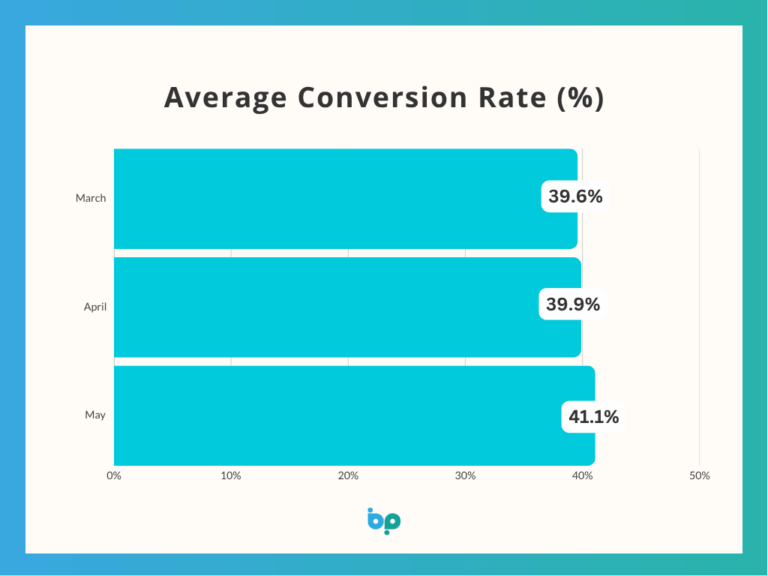

Conversion rates rose by 1.2%, from 39.9% in April to 41.1% in May. May’s rate is the highest rate we’ve recorded this year, indicating stronger buying intent and perhaps greater confidence from consumers ready to move forward with their projects.

This resilience is a welcome surprise given the fact that UK inflation rose to 3.5% in April, up from 2.6% in March, an increase largely by increased household energy and water bills.

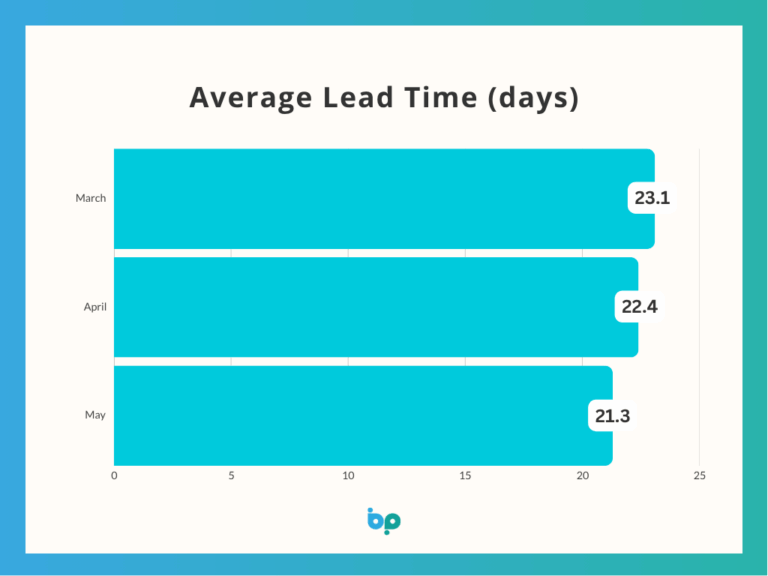

At the same time, lead times continued their downward trend, dropping from 22.4 to 21.3 days, a 4.9% improvement. That suggests homeowners aren’t just enquiring, they’re converting faster, and installers are turning leads into sales more efficiently.

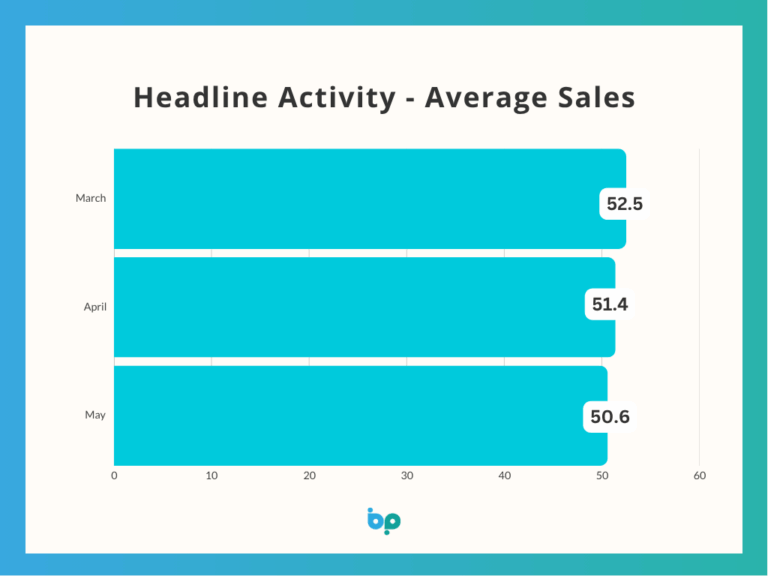

That’s despite a slight dip in sales volume, down from 51.4 in April to 50.6 in May, a 1.6% decrease – a marginal drop which still points to a stable flow of business. Given the rise in conversion, we suspect fewer but more qualified leads are coming through the door.

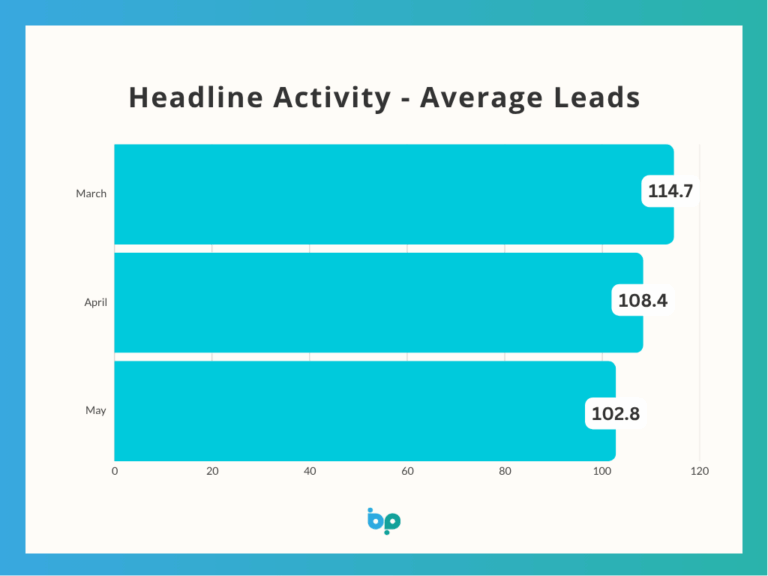

Speaking of leads, average lead volumes declined again, from 108 in April to 102 in May, a 5.2% drop. While it’s the third month of gradual decline since March’s peak of 114, we don’t view this as cause for concern. Instead, it reflects a market adjusting to seasonal patterns and consumer focus shifting as summer begins.

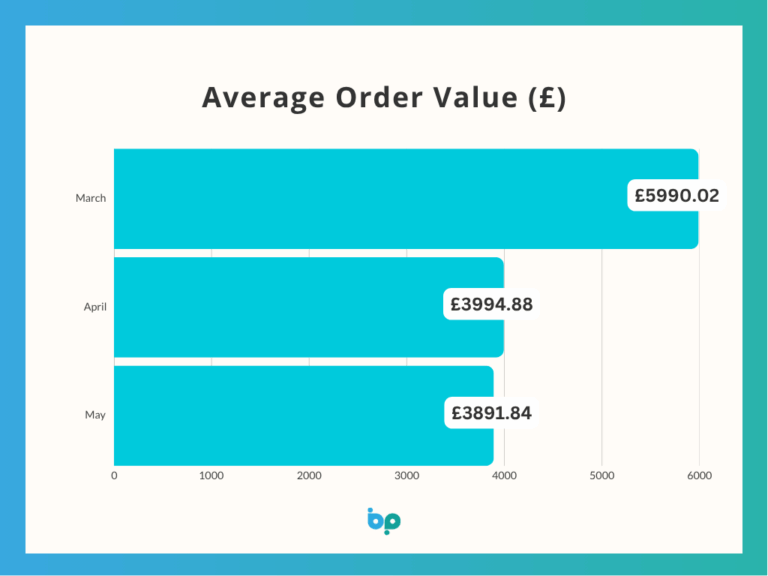

Average order values dipped slightly, from £3,994 in April to £3,891 in May, a 2.6% decrease. While down from last month, this still represents a stronger baseline compared to February and suggests buyers are maintaining mid-range spending levels. And this restraint is understandable in the context of borrowing costs.

Despite the Bank of England’s base interest rate falling slightly to 4.25% in May, the current rate continues to limit access to cheaper credit, especially for larger or premium home improvement investments.

Meanwhile, UK GDP grew by 0.7% in Q1 2025, according to the Office for National Statistics. Though modest, this growth follows a period of economic stagnation and adds to the cautious optimism we’re seeing reflected in the window and door retail space.

Overall, May’s data signals a more confident market. Buyers are acting faster and converting more reliably, even if their overall spend and enquiry levels are moderating slightly. From where we stand, this is the type of consistency businesses can plan around.

If you’re not already using Business Pilot, now’s the time to see how this kind of insight can help you fine-tune your strategy. From tracking leads and conversions to optimising your sales process, Business Pilot arms you with the data and tools you need to drive growth.