It’s a big figure but probably only reinforces something that retailers have instinctively known. Average order values crashed in the last month – by more than 50%.

This is consistent with what we have picked up anecdotally from our customers. Big ticket items and whole house replacements have been harder to get across the line, but single items, replacement doors, distress purchases, have continued to move.

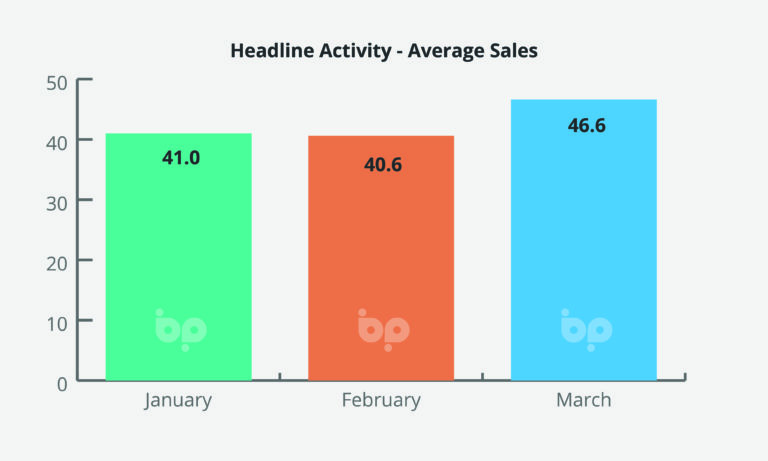

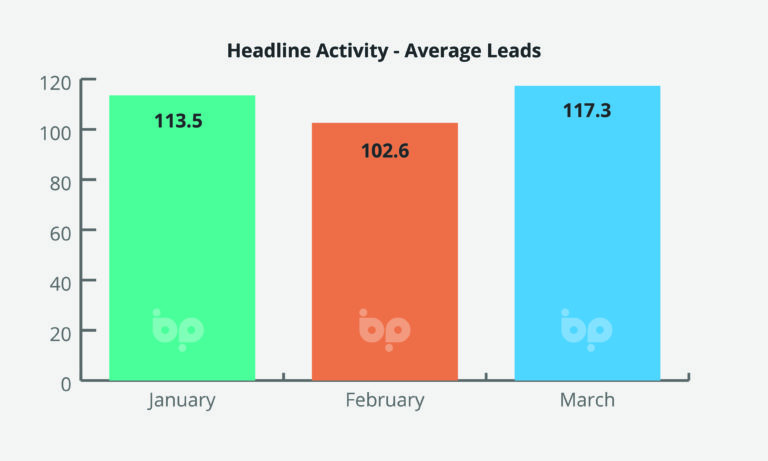

If they aren’t spending as big, homeowners are, however, still spending. Average sales were up almost 15% last month, leads were also up 14%, reversing the fall recorded in February on January.

It’s a big figure but probably only reinforces something that retailers have instinctively known. Average order values crashed in the last month – by more than 50%.

This is consistent with what we have picked up anecdotally from our customers. Big ticket items and whole house replacements have been harder to get across the line, but single items, replacement doors, distress purchases, have continued to move.

If they aren’t spending as big, homeowners are, however, still spending. Average sales were up almost 15% last month, leads were also up 14%, reversing the fall recorded in February on January.

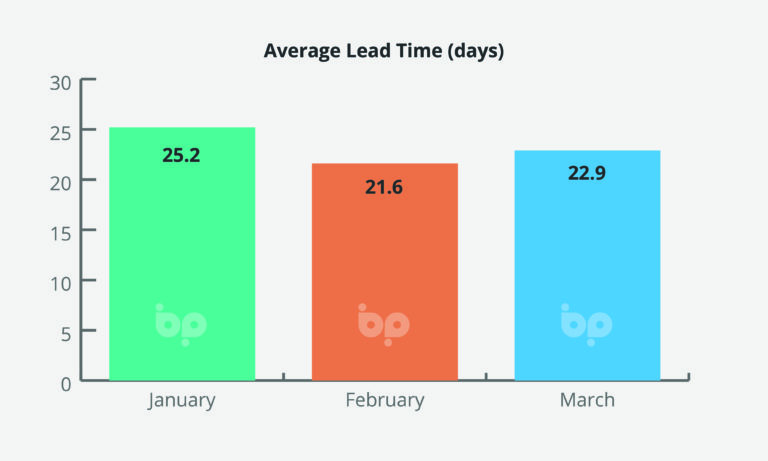

Conversion rates remained flat in March at around 33%, where they have been hovering all year. This compares to the 37.7% in summer last year, a time when the total number of leads was also 8% higher than last month’s figure.

In summary then, leads are significantly down on the hiatus of last summer and despite the month-on-month resurgence seen in March on February this year, they are harder to convert and coming in at lower value.

As we have highlighted, Government incentives have gone – and have been replaced indirectly by disincentives to invest in home improvements, so in a sense this shouldn’t be a surprise.

This includes massive increases in energy bills which will see average household energy costs top £2,000 this year, this on top of inflation and the uncertainty and volatility created by the conflict in the Ukraine.

The latter particularly has in our view accelerated the cooling of the market seen at the start of this year. As consumers adjust to continuing political and economic uncertainty, alongside the seasonal appeal of products, we believe we may see a moderate return of confidence in the months ahead.

Fundamentally, however, the landscape has shifted. We are also still to see the impact of the lifting of the energy price cap and how consumers respond to it. While reducing disposable income it brings energy efficiency into clear focus, creating market opportunities for windows and doors.