March delivered another shock to the UK economy as inflation jumped from the 10.1% seen in February, to 10.4% in March, reversing the downward trajectory and triggering another 0.25% increase in the base rate from the Bank of England.

Inflation remains at a 40-year high. Wages, which increased 5.7% in the three months to January, are falling behind but despite this, consumers are continuing to spend – something reflected in figures for window and door retail sales in March.

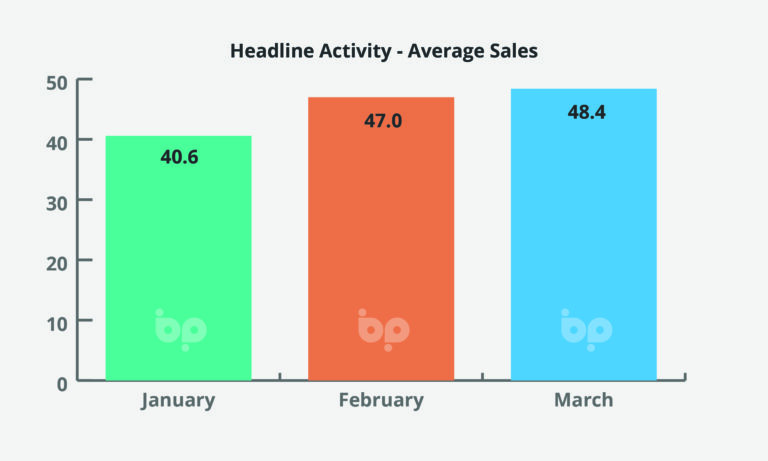

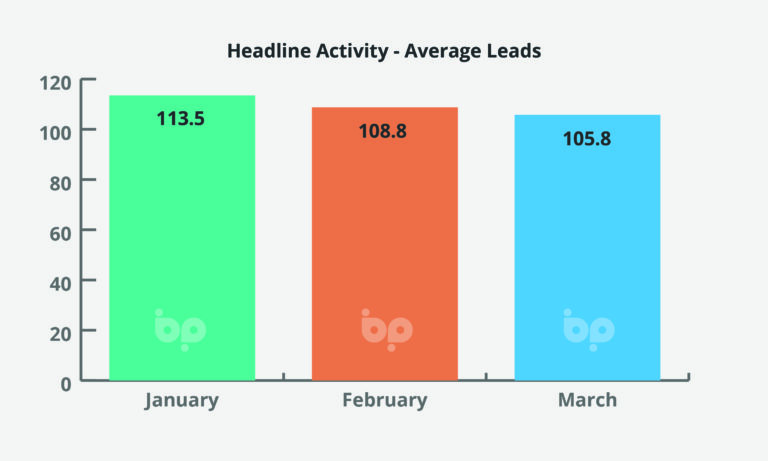

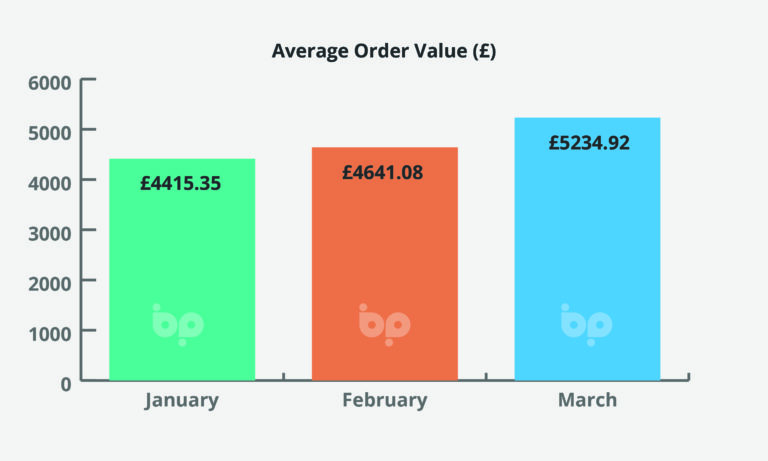

Sales were up 2% on February, while average order values jumped from £4,641 to £5,234 – a 13% uplift. Leads were marginally down.

Year-on-year, the figures are also positive with sales up 4% compared to March 2022, and average order values up 5%.

Beyond the headlines this is consistent with other areas of the home improvement sector.

Kingfisher, the owner of B&Q and Screwfix, reported a sharp decline in profits last month, after homeowners reportedly scaled back on home improvement projects, with sales down 0.9%.

It said however, that big ticket items including kitchens and bathrooms remained broadly flat. Total like-for-like sales were 2.1per cent lower in the last year, but still 15.6% above pre-pandemic levels, with £1 in every £10 it made last year coming from energy-saving products.

The parallels with our own sector are striking. The market in Q1 has been flat. Down compared to the Covid-boom, but still around 11% ahead of where it was pre-pandemic.

And energy efficiency is the key driver. The Government may have extended support and wholesale energy prices may be coming down, but they remain at historically high levels.

Electricity prices increased by 67% in the 12-months to February, while gas rose by 129% taking average bills beyond the £2,500 a year mark.

New figures released by the Office for National Statistics suggest that the impact of rising energy prices is causing people to change their behaviour over winter.

According to the ONS More than half of adults (54%) said they are using less fuel, such as gas or electricity, in their homes because of the rising cost of living.

Closer to home a survey at the start of this year by systems company Deceuninck, found that more than 90% of respondents were worried about the price of energy.

This may go some way to explaining the uptick in average order values seen last month, as homeowners shift spend to whole house replacements.

Even as energy prices come down, the psychological scarring that it has left in consumer psyche makes it likely that energy efficiency will remain a key driver of window and door sales for a very long time to come.

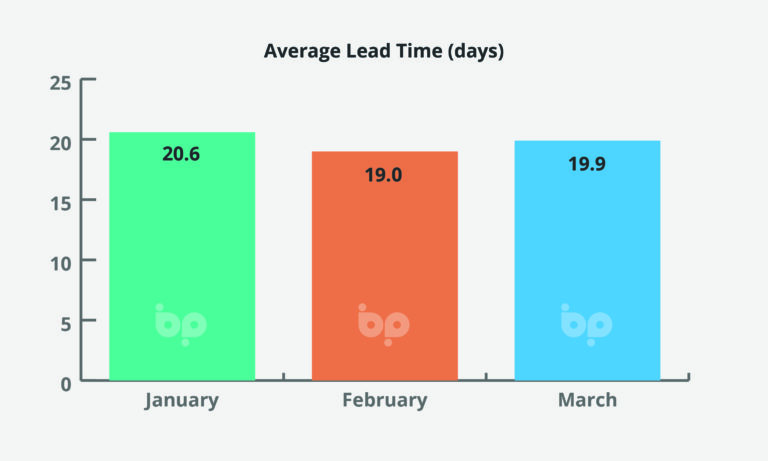

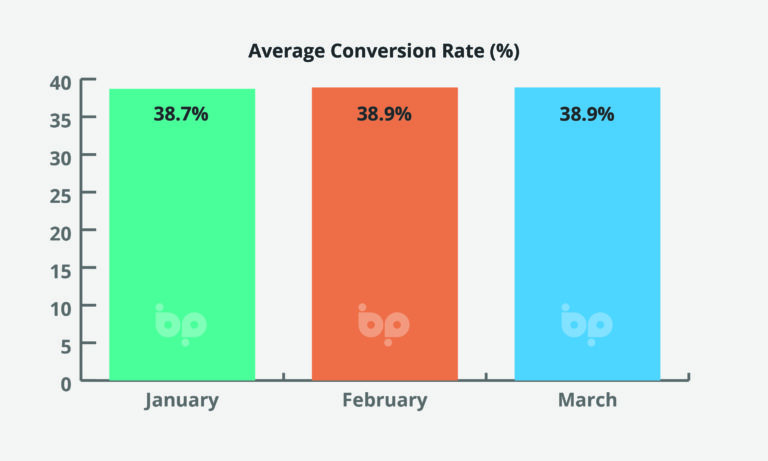

As always, against this context, understanding where your leads are coming from and maximising conversions is going to be key.

With a sophisticated lead tracking capability, lead heat mapping and sales pipeline management tool, Business Pilot helps you maximise leads, manage their conversion and then simplifies project delivery maximising your profitability on every job.