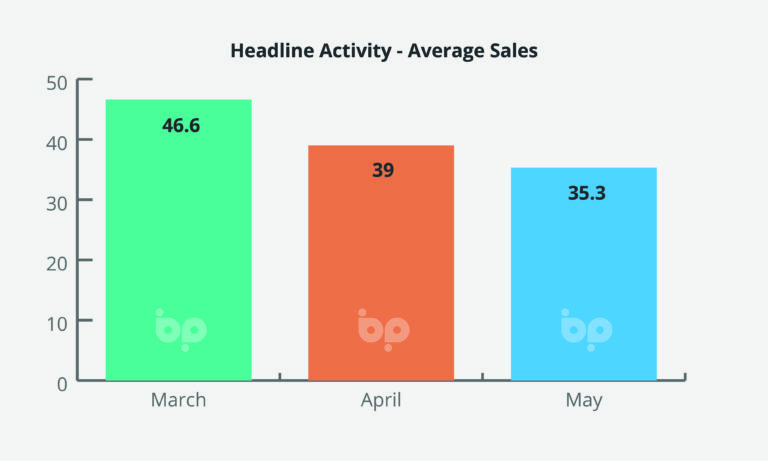

This month’s figures evidence a continuing slowdown in the home improvement market with sales down 9% in May on April, which recorded a drop of 13% on March. This means that over the three-month period average sales fell by 46%.

Compared year-for-year, May 2021 to May 2022, the drop is 25%, which seems to sit about right for what we’re hearing from retail customers.

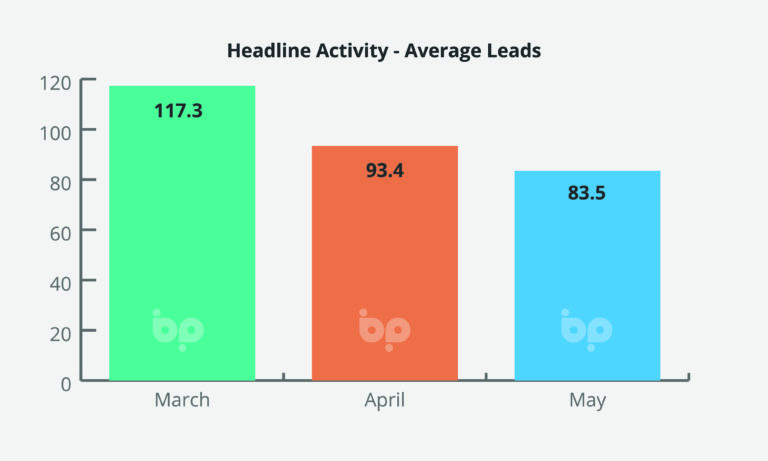

Leads are similarly down by around 11% in May on April and 29% over the three-month period. Year-on-year, the drop is 24%.

We believe that we’re now seeing a very clear synergy between the cost-of-living crisis and lower levels of consumer confidence, something compounded by war in Ukraine and increased competition for consumer spending as the economy opens-up.

There was always a predictability to this last point. UK summer holiday bookings are up a fifth on pre-pandemic bookings according to TUI. The opportunity to get away after two-years of COVID, was

inevitably going to redirect consumer spend from home improvements to travel, eating out and a broader spend.

Energy price increases have tipped the balance further. While it may feel that the increases have come out thin air, they were in fact long predicted – it’s just not many of us listened. Nonetheless, they culminate in another hit to consumer confidence and tightening of belts.

It isn’t, however, all doom and gloom. House prices increased by a better-than-expected 11.2 per cent in the year to last month, although down from April’s 12.1 per cent and a high of 14.3 per cent in March, according to the Nationwide house price index.

This is something that should help to sure-up the nerves of those consumers with greater capital behind them that investment in their properties, will, in the longer term pay dividends.

Energy price increases, as we have stated before, should give additional impetus to those who have the cash, to make energy efficient home improvements.

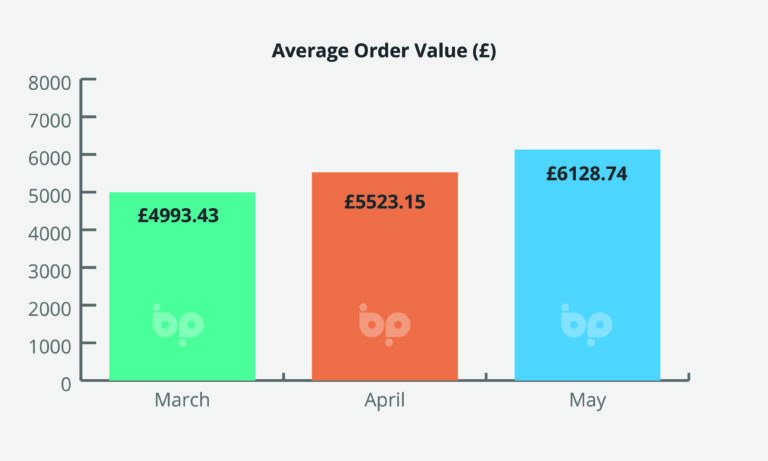

This is also reflected in the increase in average order values for windows and doors seen last month of 11%. Year-on-year this figure jumps by 55%

This appears to evidence a shift away from the more ‘casual’ spending on home improvements that we saw during lockdown, for example single product purchases, particularly doors and bi-folds, to a more discerning and strategic spend on whole-house improvements.

Where the market bottoms out, is still unclear. It’s too early to say if we’re seeing a readjustment or the start of a downturn.

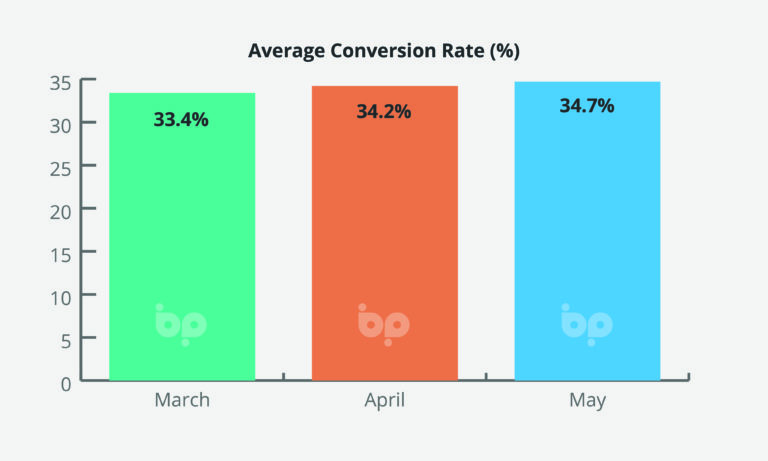

Either way, it appears things are going to be tougher, certainly than they were, and tightening up on your sales and operational processes, to convert more and get more from your teams by automating repetitive tasks and working in a far more connected way is sensible.

We have customers who have saved upwards of £40,000 a year by understanding and tracking operations more effectively. That could be £40,000 back on your bottom line, without having to sell more or work any harder.