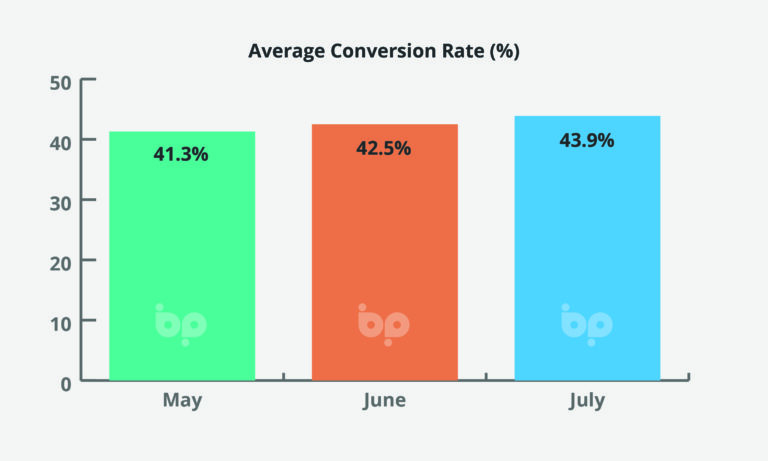

Business Pilot users are on average converting 43.9% of leads. This is a 3.3% increase on the already high June figure of 42.5%, and a whopping 26.3% increase on a year ago (July 2022). In February 2022 – 18 months ago – the average conversion rate was 32.8% and it has increased every month since then.

This is a fascinating statistic, and one we’ve discussed a lot recently. In my opinion, there are two things going on. Firstly, you’ve got fewer tyre kickers. If you get an enquiry from a homeowner looking to replace doors and windows, then they are likely to be serious – they will have a budget, a source of finance, and a commitment to buying.

Secondly, they will have conducted some of their research beforehand, and are approaching fewer than three window companies for quotes. In an increasing number of cases, they will be approaching just one.

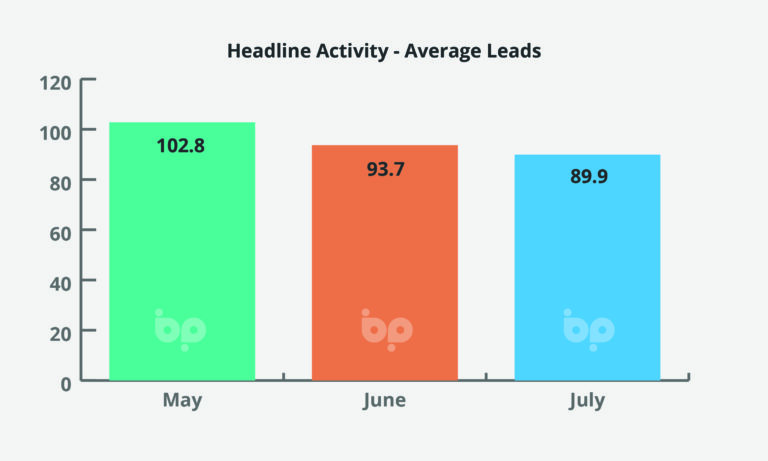

The go-to statistic for many companies when the Business Pilot Barometer is published is the ‘average leads’, and this month we’ve continued to see that month-on-month decline since the start of the year; at 89.9, average leads are 4.1% lower than last month.

But this is still 16.1% higher than the same period last year, and if you take into account the increased conversion rates (a higher conversion rate figure implies fewer leads) then this may not seem so worrying.

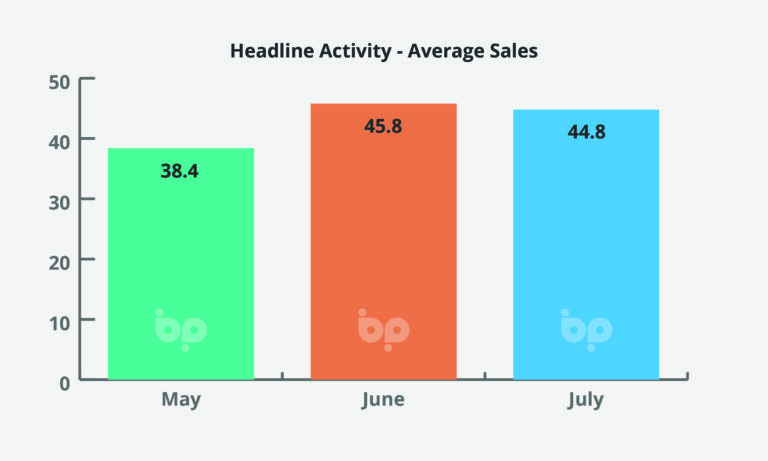

Supporting this view of the market is the average sales; at 44.8 – just 2.2% lower than June 2023 – sales are holding their own. They are also 31.4% higher than July 2022.

Window companies are clearly making every lead count and capitalising on every opportunity.

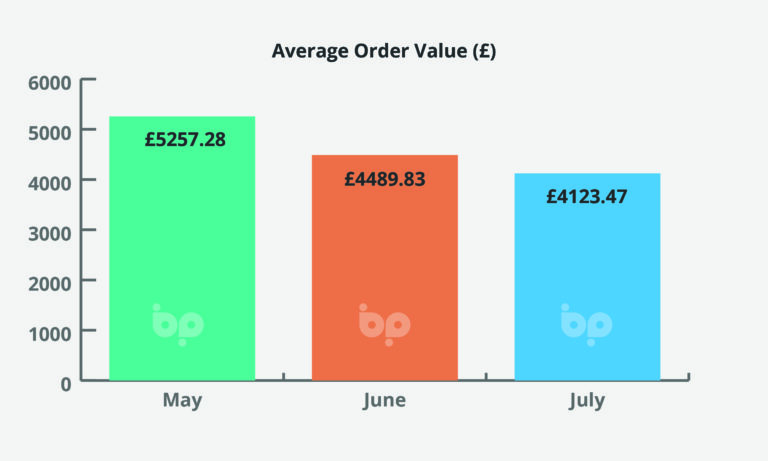

Meanwhile, the average order value in July 2023 dropped 8.2% to £4,123.47 when compared to June 2023. This is also 8.9% lower than a year ago (July 2022). Going through the data for the last three years there are clear seasonal changes to the average order value, and if the next two quarters follow a similar pattern to 2021 and 2022, then we should see average order values increase by the end of the year.

At 7.9%, inflation continues to fall, but it is still too high, and will put pressure on the Bank of England to raise interest rates at the beginning of August. At the time of writing, the base rate was 5% which, while still historically low, will put pressure on household finances where low fixed rate mortgage deals are coming to an end.

Inflation also reduces discretionary spend, and is likely to reduce the number of households looking to improve their homes.

At the same time, the housing market is sluggish. According to Zoopla, annual UK house price inflation slowed to just +0.6%. Significantly, annual falls of up to -2.2% were reported in southern England and markets with an average price of over £300K (affordable markets in economically active areas are still registering annual house price inflation of over 3.5%). Also, higher mortgage rates have reduced demand by 18% in the last two months, according to the property website.

Zoopla said it expected to see house prices continue to fall overall – up to 5% lower over the course of 2023.

Combined, this says two things: there is less money at the lower end of the market for new windows and doors; but an increase at the upper end where homeowners are delaying moving because a) interest rates are too high and b) moving now would mean paying over the odds.

This scenario fits with the Business Piot Barometer’s figures: volume is down, but homeowners are investing wisely when they decide to invest, resulting in a net gain for window companies.

It is also worth noting that the interest in aluminium as a window material reflects this shift to the higher value activity; sales of aluminium increased while those for timber and PVC-U dropped (albeit modestly).