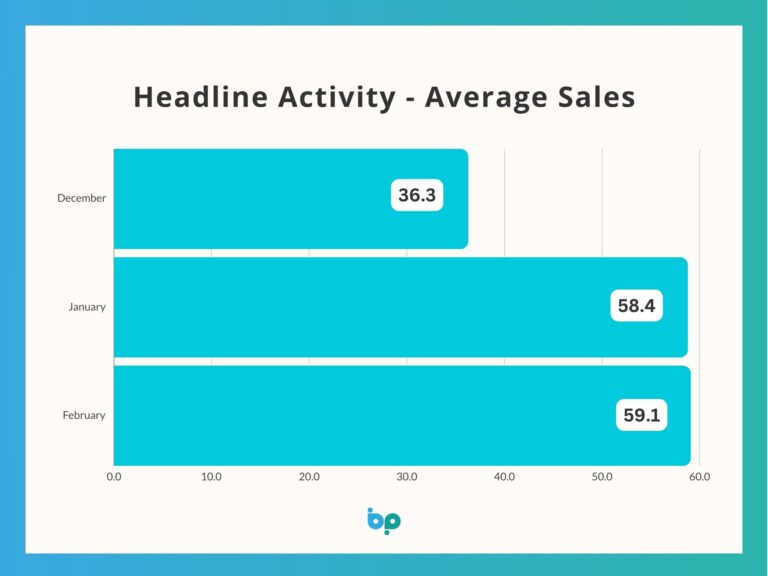

Average sales increased again in February. It may have only been by 1.2% to 59.1, but it demonstrates that the big leap in January wasn’t a one-off. It is also worth noting that this figure is 25.7% higher than the same period last year.

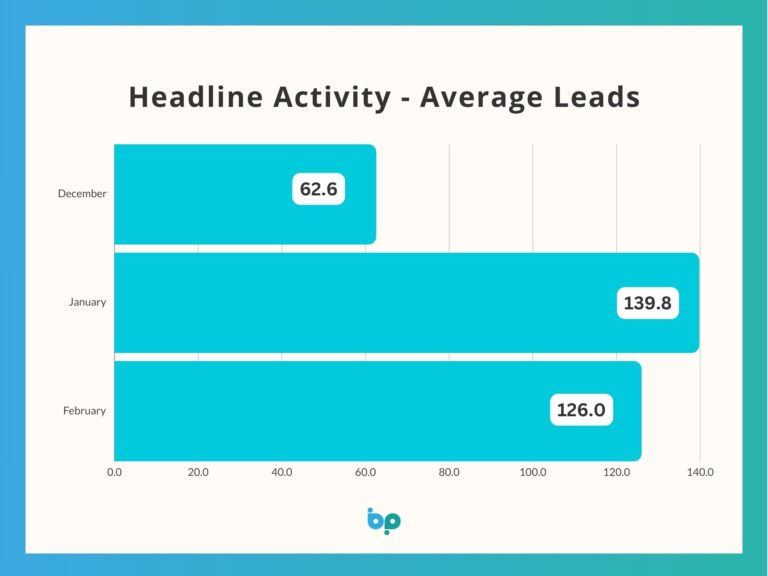

Leads have fallen back marginally – down 9.9% to 126 – but they are still 15.8% higher than the same period a year ago.

In most years we see both average sales and average leads drop back in February, most likely because January is a correction following a quiet December. Only in 2021 did we see both sets of figures increase in February, and that was when demand went through the roof following Covid.

This year, many people are expecting a difficult year, but so far this isn’t reflected in the data – especially from a retail point of view.

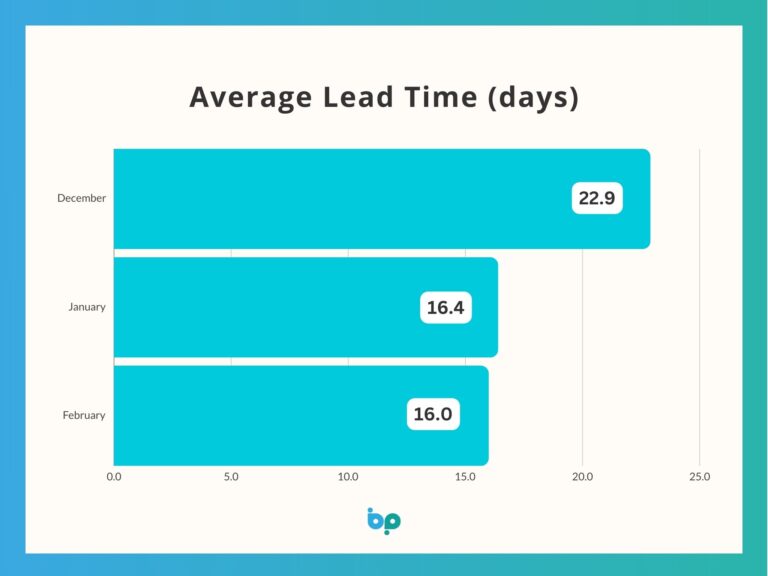

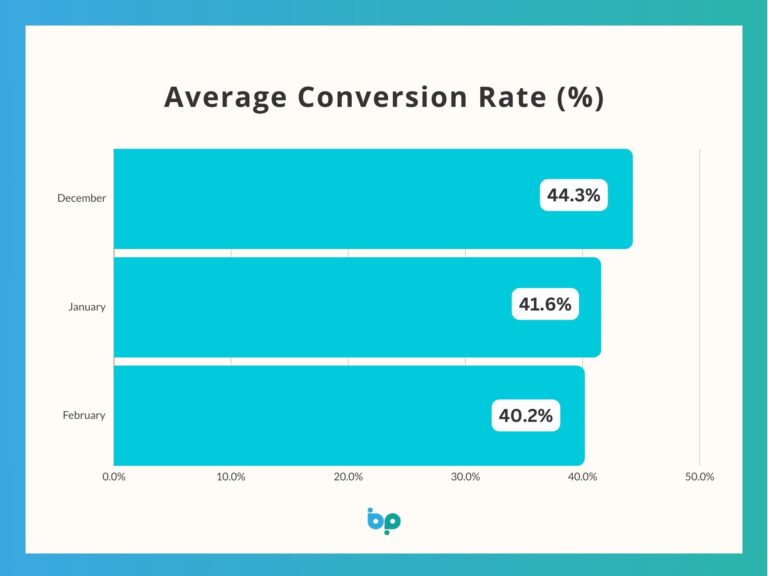

When we take the other metrics into account, an interesting picture starts to emerge. Remember, when looking at this data, that the current mood music is one of negativity and concern that 2024 is going to be a tricky year.

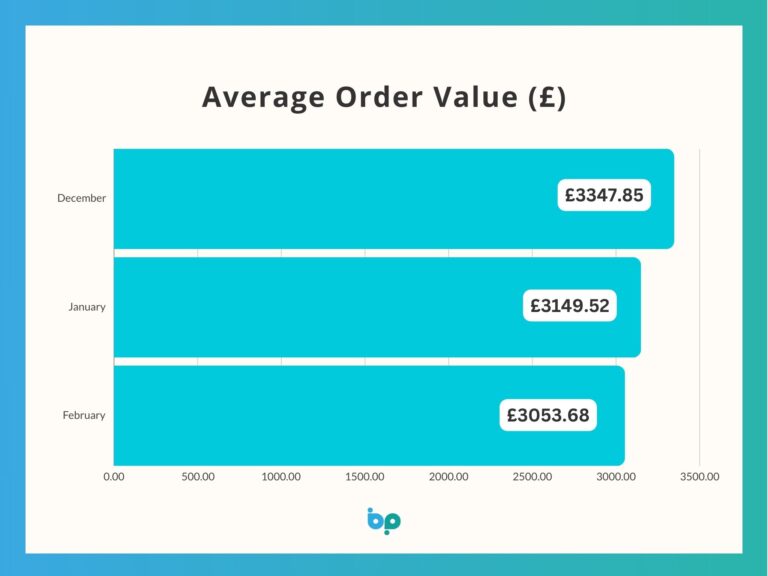

First of all, the average order value for February 2024 fell by 3% to £3,054. And this figure is 34% lower than the same period last year – which itself was actually a small increase on the previous month.

But this time last year was characterised by a fall in demand in the volume market, which is why we saw average order values remain high. The fact they are lower this year – and currently falling month on month – suggests that either demand is driven by distress purchases, or the volume market is picking up.

The fact that average leads are considerably higher this year makes me think that it is the latter.

I can understand why some people are jumpy when we continue to see companies enter administration. Take fabricator Euramax for example, which manufactures and supplies PVC-U windows and doors for sectors including modular construction, leisure and DIY.

It entered administration following the collapse of a major customer, and reports reveal that profitability had dropped considerably since the beginning of 2020; for the year ending June 30, 2022, it reported a turnover of £26.5 million, with pre-tax profits of £129,000. That’s a profitability of less than 0.5%.

There have been – and will be – others. Euramax isn’t the best example, because they are a commercial fabricator, but it does serve to remind us that we all need to keep an eye on profitability, and that cash is king.

The most effective way to do that is to keep a daily finger on the pulse of your operations. With Business Pilot, you can feasibly check every job to ensure that a healthy margin is built in because you can see the cost of everything – labour, materials, transportation, office overheads – as well as the overall value.

If we learned anything from the aftermath of Covid, it was that fantastic sales can often mask poor profitability, especially as the cost of raw materials rise. We know that if business leaders don’t keep a constant eye on this, then it could spell trouble.

But Business Pilot can give you the numbers you need to keep on top of your business, so there is no excuse to be in the dark.