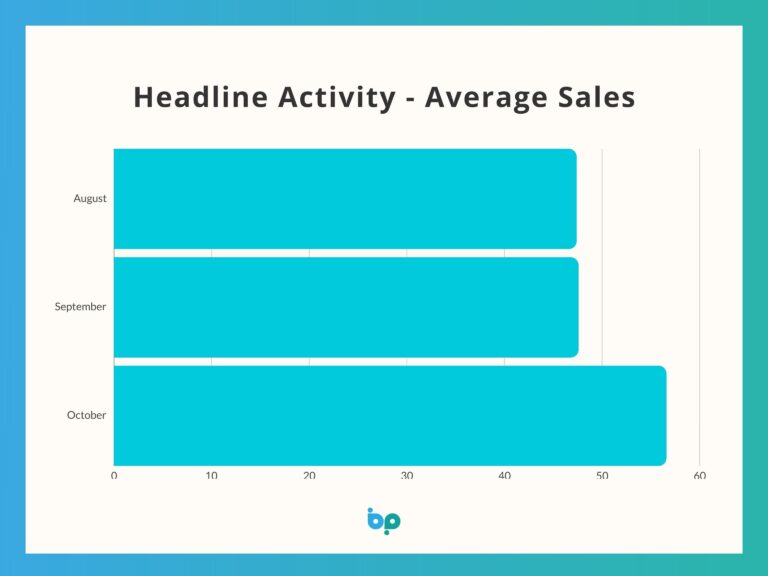

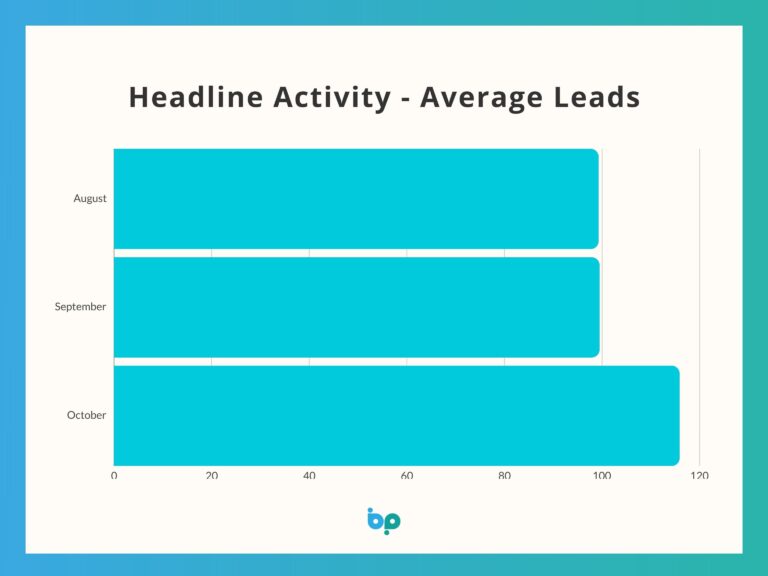

At a glance, the Business Pilot Barometer figures look promising for October 2023: average leads were up 16.5% to 115.9, and average sales jumped 18.9% to 56.6. And compared to the same period last year, they are up 23.8% and 28.9% respectively.

It is worth remembering that this time last year, the market was still reeling from Liz Truss’s and Kwasi Kwarteng’s disastrous mini budget on September 23, 2022, when sterling fell in value against the US dollar, and inflation jumped to over 10%.

This time last year homeowners were facing the prospect of a winter with unusually high energy costs, while the war raged on in Ukraine, which fuelled further uncertainty.

Not ideal conditions for home buying/selling or, indeed, home refurbishment.

In fact, house prices have been falling slightly, and Nationwide building society reported at the beginning of October 2023 that they are 3.3% lower than they were a year ago.

The good news, however, is that there was a month-on-month increase of 0.9% to October 2023, which added £1,600 to the cost of the typical property. Economists had been predicting a continued fall in house prices, so this increase has come as a surprise to many.

But context is everything. It is unlikely that October’s small increase in house prices will signal the start of a house boom – especially this side of Christmas – and mortgage rates are still on the high side, especially for those homeowners who have got used to historically low interest rates.

We in the glass and glazing industry are also looking at the market through our own lens, and the recent collapse of both UK Window & Door Group and Safestyle will leave many of us cautious, especially as we have seen leads and sales struggle over the course of the year.

I think that we will need to view Q4 in its entirety to get a true picture of how the market is behaving as we head towards 2024 – one swallow doesn’t make a spring.

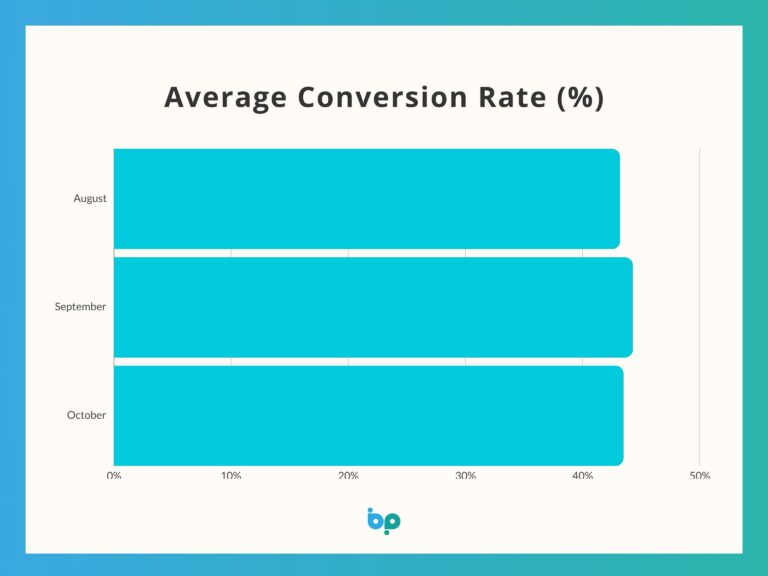

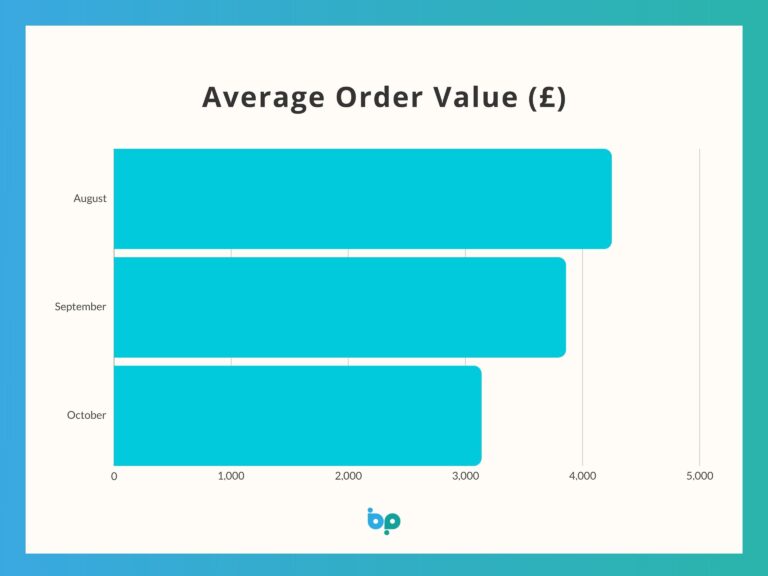

But the fact that we are seeing leads up, sales up, the average order value drop 18.7% to £3,140, and the average conversion rate fall back slightly to 43.5%, suggests that the volume end of the market is starting to pick up again, hinting at a return to confidence.

Going back to the surprise increase in house prices this month, the simple driver for this is that demand is outstripping supply. And if this is the start of a slow upward trend, then homeowners who have been delaying a decision to move may want to get the ball moving if they think the market has already bottomed out.

When the Bank of England kept interest rate rises the same at the start of November 2023, it said that we shouldn’t expect any changes until Q3 2024. While this is obviously not set in stone, those thinking about moving house may also decide to bring forward plans if mortgage rates are unlikely to fall dramatically in the next 12 months.

Could we see a positive end to a tricky year?