What a difference a month makes. As we entered November, the feeling – based on Business Pilot’s data – was that 2024 had finally turned a corner and that the brakes were off as we cruised into 2025.

Instead, we are seeing leads and sales fall back to levels seen earlier in the year.

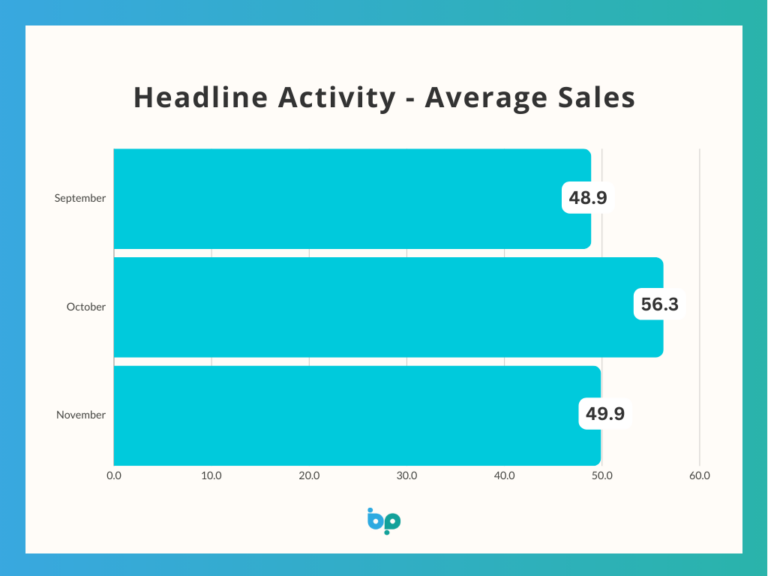

During November 2024, average sales were 49.9, which is 11.4% lower than October 2024.

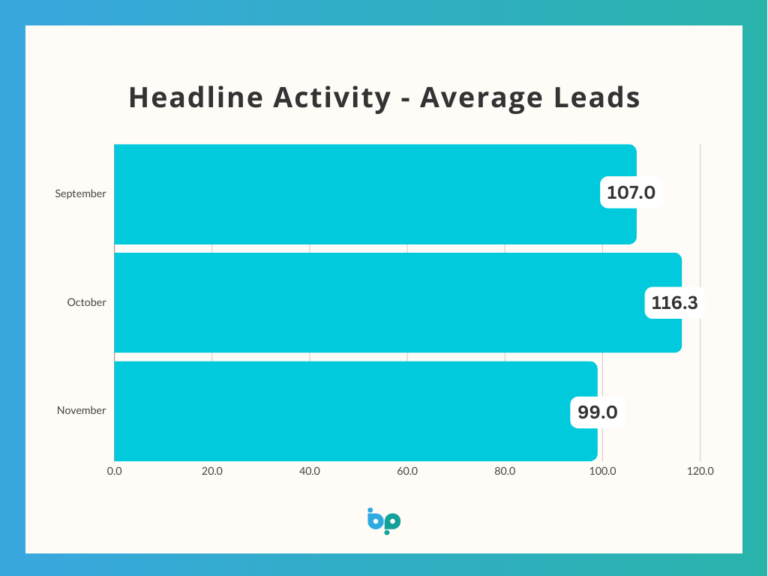

And average leads were 99.0, which is 14% lower than October 2024, and 7.5% lower than the previous month (September 2024).

Together, these suggest that homeowners responded with caution following the budget at the end of October.

Other headline figures in November 2024 were:

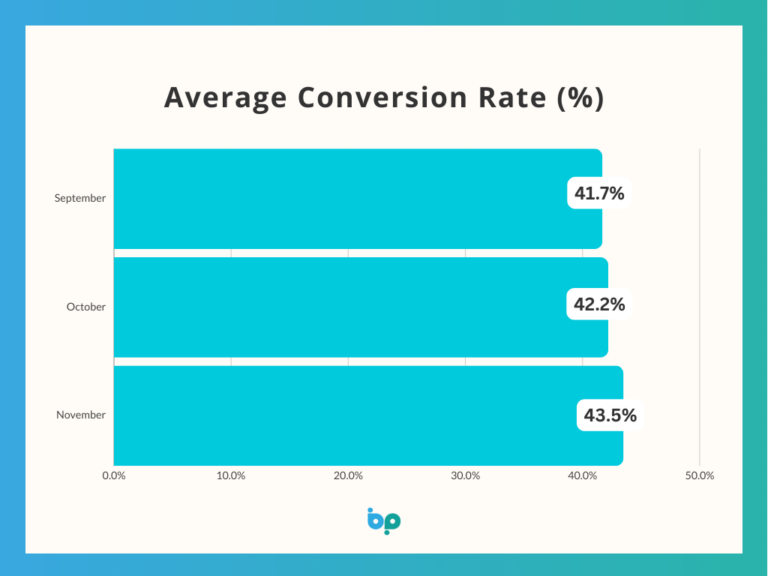

- Average conversion rate was 43.5%, which is 3.1% higher than October 2024 (the highest this year)

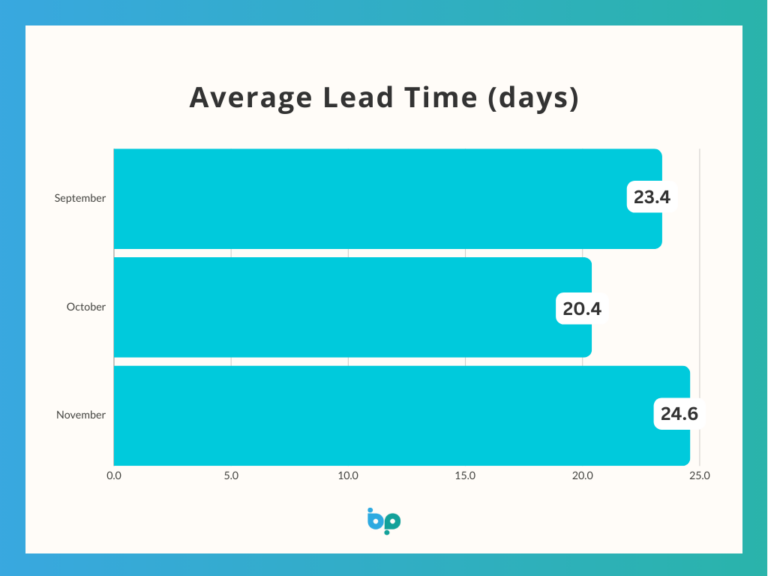

- Average lead time was 24.6%, which is 20.6% higher than October 2024

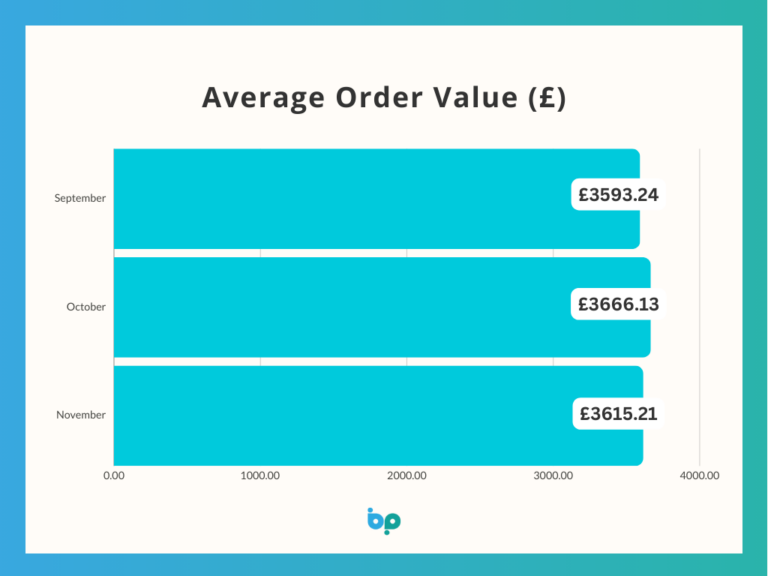

- Average order value was £3,615, which is just marginally lower than October 2024

I think this is an example of consumers responding to the overall shift in mood expressed by businesses and the media following the budget.

On the one hand, the increase in the minimum wage will put more money in people’s pockets, which was followed by a drop in the Bank of England’s interest rate to 4.75%.

While on the other, the target inflation rate jumped to 2.3% (above the BofE’s target rate of 2.0%), and there were warnings that the effects of the budget (including increasing NICs) would lead to further inflationary pressures and potential job losses.

So, instead of homeowners feeling confident that they can spend disposable income on home improvements, it appears that they could be waiting to see what happens before committing.

It is also worth pointing out that these two headline figures are significantly lower than a year ago – average sales in November 2024 are 14.6% lower than in November 2023, and average leads in November 2024 are 11.1% lower than in November 2023.

If people were looking to 2025 to offer the volume that was lacking in 2024, then the immediate signs are that this will not be the case.

It also supports anecdotal evidence that suppliers and retail companies are lowering their expectations for 2025 – for the first half at least – and that each lead that crosses your desk is valuable and should not be wasted.

Which is why Business Pilot is a vital companion, since it helps you track every project from lead right through to sign off, helping you to maximise efficiencies along the way and building trust with your customers.

Business Pilot will also give you this data in real time, allowing you to adjust your strategy proactively rather than reactively. This could allow you to target new customers with new products before your competitors.

There are many reasons why homeowners buy new windows and doors – the confidence to do so is just one of them. For example, with the recent cold snap, many people will be looking to make improvements to their home’s energy efficiency, a move which is generally supported by the national press.

There are also signs that the housing market is picking up, which also typically leads to a corresponding uptick in refurbishment work.

According to the latest survey from Nationwide, house prices grew at the fastest annual pace for two years in November.

Next month, we will get a clearer idea of how the land lies as we start the New Year.