Our Blink Payment API is now live!

This has been a major piece of development work and one which we hope will bring lots of time and cost-saving benefits to Business Pilot users who are looking for easier ways to take payments from customers.

If you’re on board with Blink Payment already, you can now set-up your integration and start generating Payment Links.

Here’s all the information you need to know on the new Blink Payment API…

Blink Payment – Payment Links

Blink Payment customers can now generate Payment Links (sometimes referred to as Paylinks) which your customers can use to make payments to you.

There are two payment link types available:

- Invoice Payment Link – these are Payment Links created specifically for paying an invoice. You can see these under the Invoices tab of your Contract page.

- Contract Payment Link – this is used for payment on account (POA). This can be found under the Invoices tab of your Contract page.

Taking Payments via Payment Links

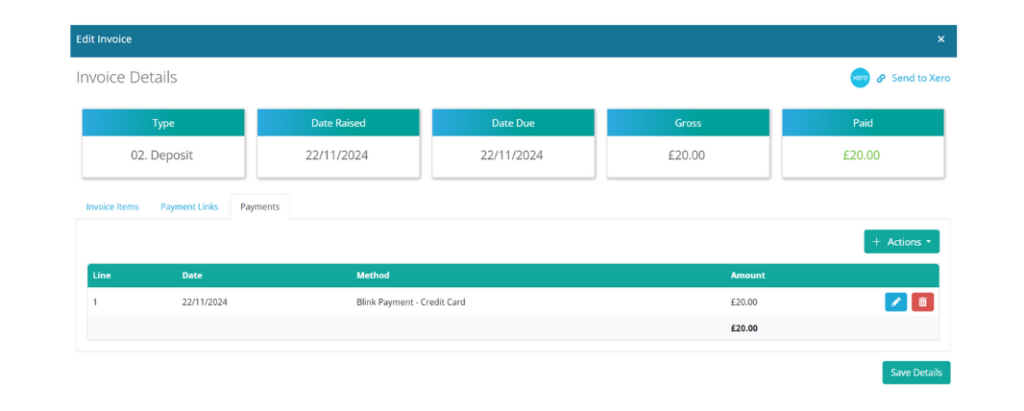

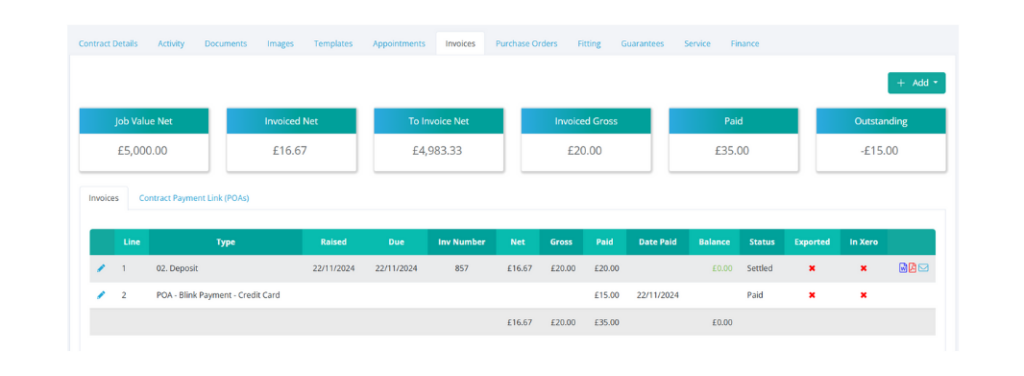

When your customer makes a payment using a Payment Link, it will automatically be added as a payment in your Business Pilot system.

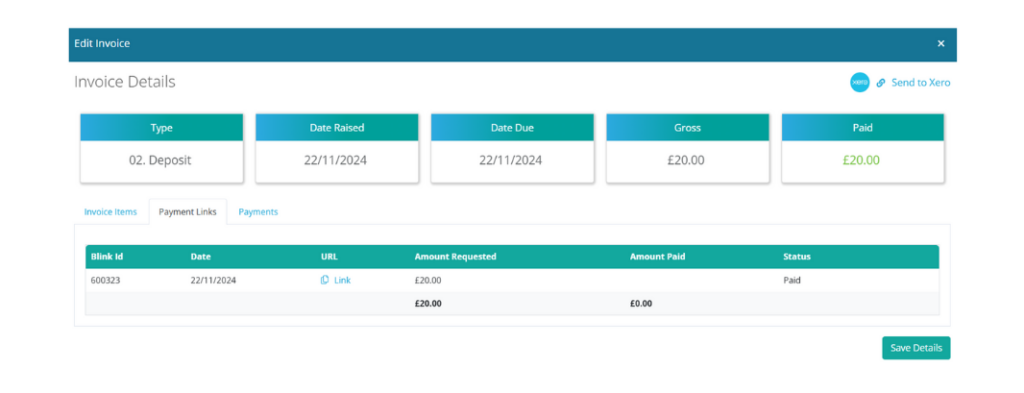

So, when an Invoice Payment Link has been paid, it will show as paid on your invoice in Business Pilot as shown here:

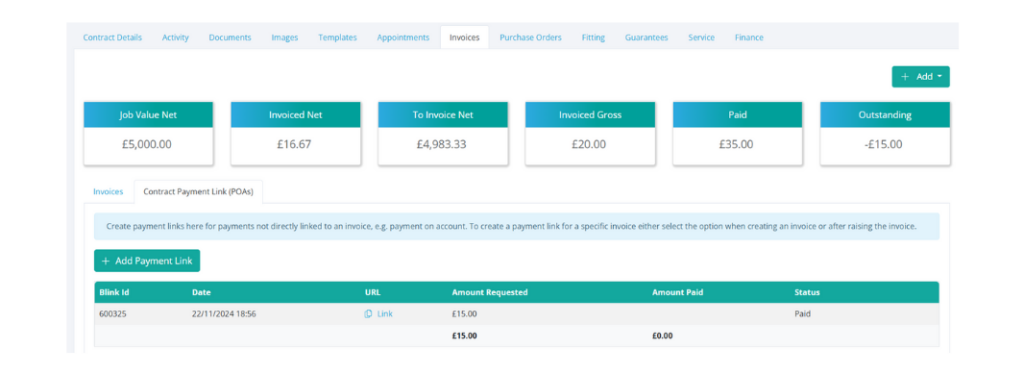

And when a Contract Payment Link has been paid, the status of the POA will update to paid and show the payment method details and amount.

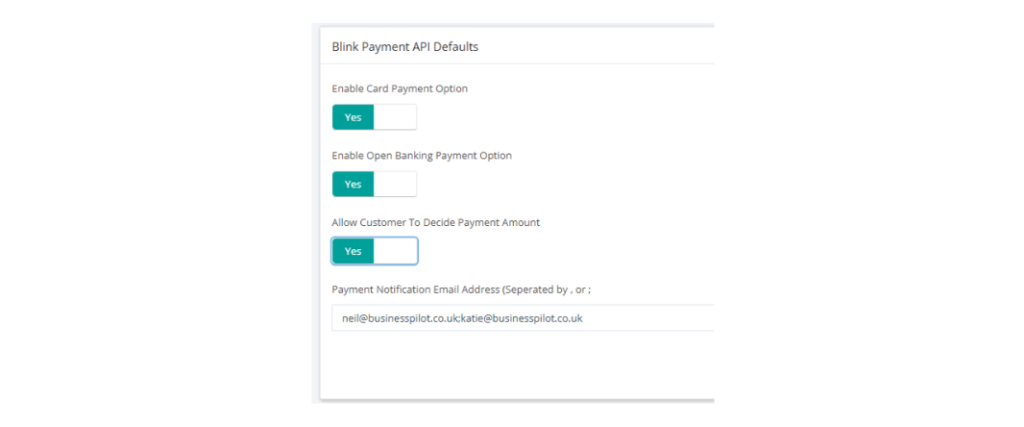

Payment Notification Emails

There is also the option to send notification emails to your team whenever you receive a payment.

This is easily set-up in the Blink API settings and the notifications can be sent to multiple email addresses if required.

Blink Payment Options

Blink Payment offers a number of payment tools via its online platform, so you can keep all of your payments together in one place.

This includes open banking, for bank transfer payments, and card payments, for credit and debit card, Google Pay and Apple Pay transactions.

Blink Payment integration set-up

For more details on the integration and a guide on how to connect your Business Pilot system to your Blink Payment platform and generate Payment Links, please head to our knowledgebase article here.

Get onboard with Blink Payment

If you’re not on board with Blink Payment yet, it’s time to book your free 30-minute consultation call.

In our experience, Business Pilot customers have saved money on their payment processing fees with Blink Payment, compared with their existing payment providers, so it’s worth discussing what rates they can offer you.

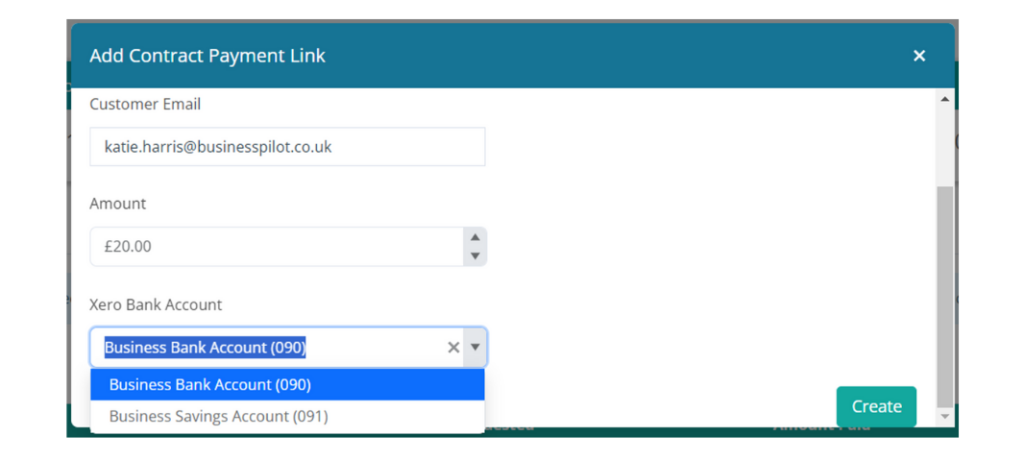

Integrating Business Pilot, Blink Payment & Xero

For users who also integrate Business Pilot with Xero, there are additional benefits.

Connecting your bank accounts to Xero and Business Pilot means you can specify the account that the money should go to for each Payment Link.

So, for example, if you have a separate account for collecting deposits, you can set it up so that all Payment Links created for a ‘Deposit’ Invoice Type will direct the payment to that bank account.

You can also manually choose the appropriate account when you create a Payment Link.

This feature means that the auto reconciliation inside of Xero will match the live bank account transactions to the ones in the Xero account (or highlight the differences).

If you have any queries or need any help with these latest updates, or integrations please contact our support team via the live chat button, or on 0333 050 7632.

For any queries regarding the Blink Payment platform, please contact Blink Payment directly.