I’m going to start this month with a focus on longer term trends because this broader context is important in helping us to understand what is happening now.

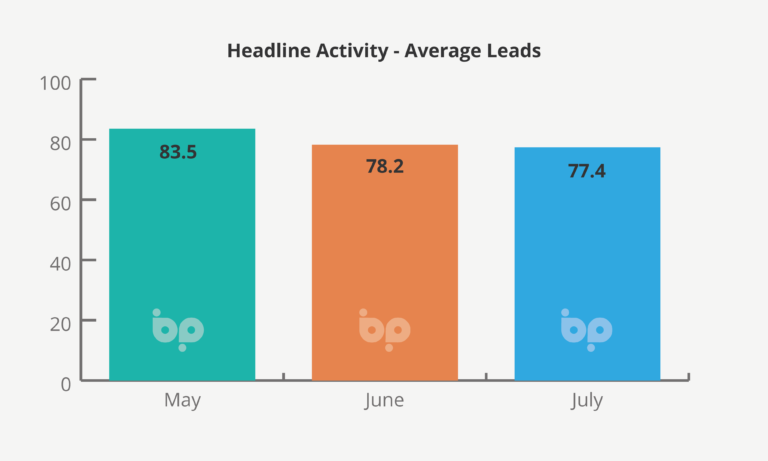

Year-on-year sales this July are down 29% on where they were in 2021 and 60% on where they were in July 2020. Leads are down 27% and 50% over the same period.

That is a fall – and a big one. We could, however, spin the statement on its head and say that the market in 2020 and 2021 was artificially inflated by the Stamp Duty holiday and multiple lockdowns by 60% in 2020 and 29% in 2021.

The reality is that we have seen a normalisation of the market in the first half of this year. We shouldn’t get hung up on the drop from 2020 or 2021 because we were operating in a bubble. A bubble which has now burst.

We should remind ourselves, however, that we are still some way from a cliff edge, although for my money, trading conditions will continue to toughen through to the ed of this year and into next.

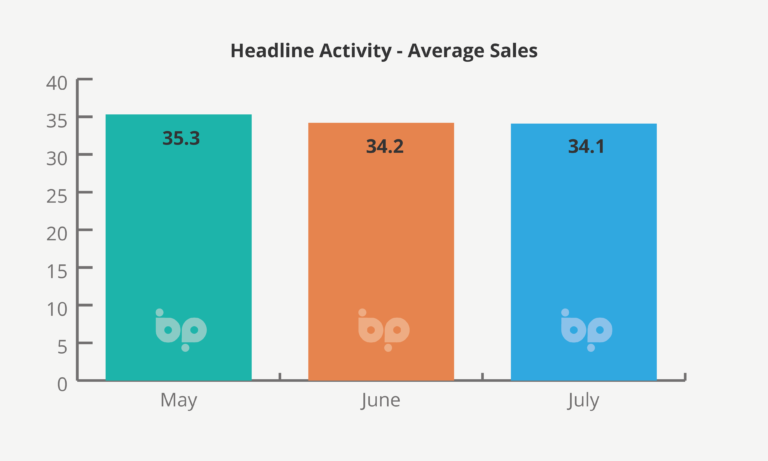

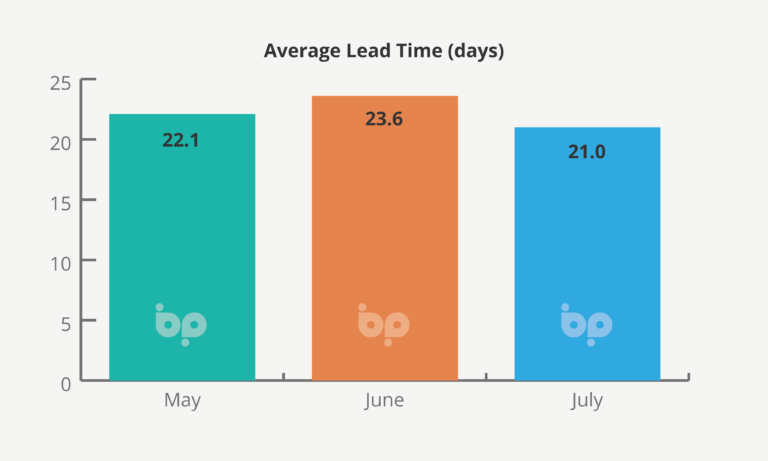

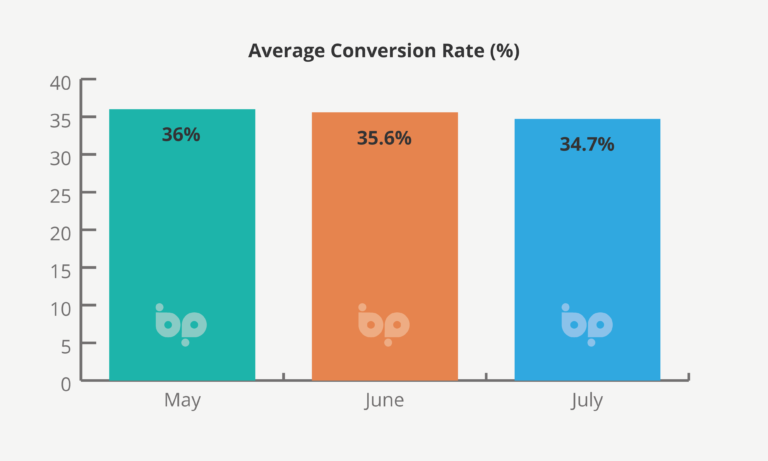

Sales July-on-June were down, but not by much (0.5%). Leads fell by 1%. That’s a very minimal month–on-month change.

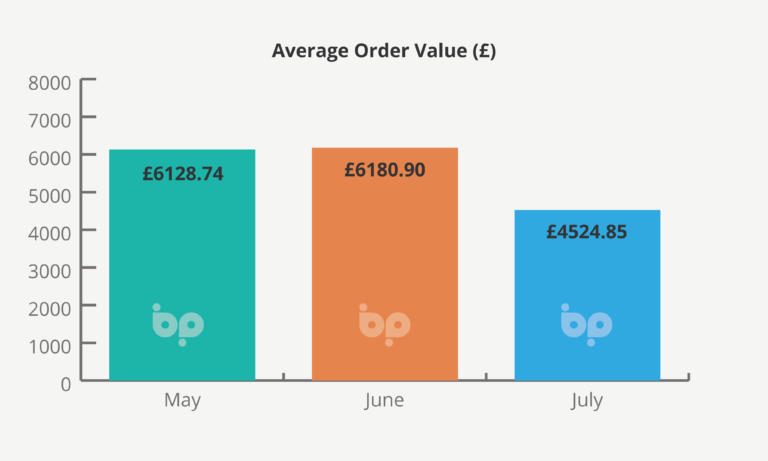

What is more notable is that average order values dropped by 27%, reversing the increases seen in preceding months, although year-on-year, 2022 compared to 2021, they remain up by 15% and significantly up on the same time in 2020 at 28% higher.

The question as we have stated before is how much of the slowdown seen in the first half of 2022 can be attributed to an inevitable normalisation of the market and at what point inflationary pressures did or will kick in and their impact on consumer spending?

Consumer confidence remained unchanged in July at 41.0 (GfK). This reflected June’s record low as households reassessed their budgets in thew face of rising costs.

Forecasts that average household energy bills are set to top £3,500 and go as high as £3,800 from October, can be expected to push consumer confidence still lower.

The housing market is also slowing. Although still recording growth inflation fell to 0.3% last month.

So, what can we draw from what are a very complex set of economic and market factors.

We can say that the market has readjusted. The boom is over. Consumers are tightening their belts and there is growing pressure on household budgets.

At the same time, the biggest single driver of that shift – energy prices – gives homeowners a direct incentive to invest in the energy efficiency of their homes.

If you have the cash, have older windows or maybe moved last year and held off improvements because the market was so insane, now is a good time to spend. It’s a question of positioning and effective marketing.

With a sophisticated lead tracking capability, lead heat mapping and sales pipeline management tool, Business Pilot helps you maximise leads. Down 27% year-on-year, that becomes an almost, if not absolutely, business critical exercise.