October was another month of political and economic change on an historic scale. Despite it (or perhaps because of it?) homeowners have continued to spend on home improvements.

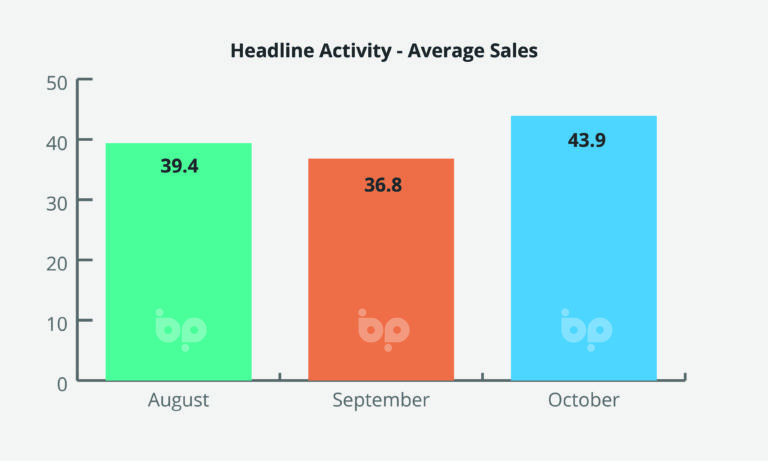

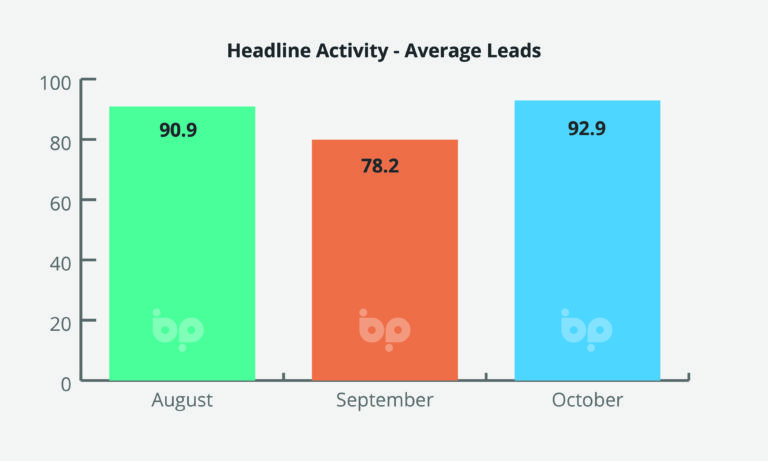

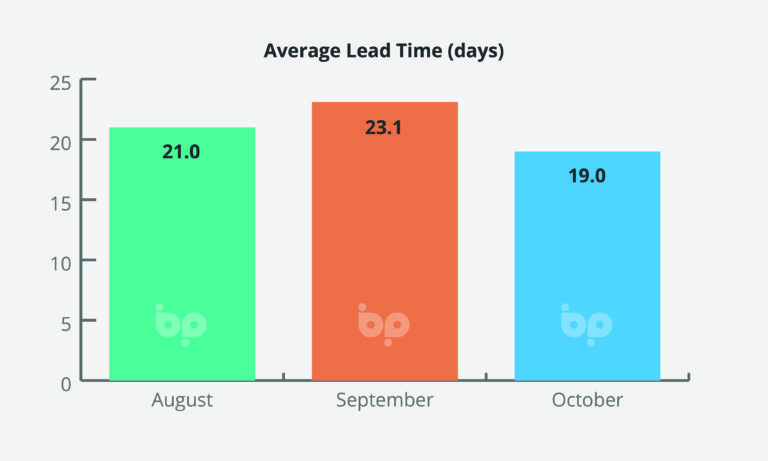

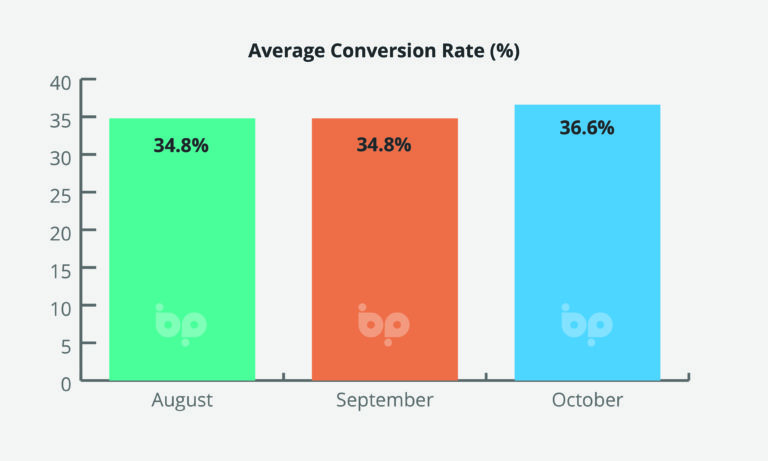

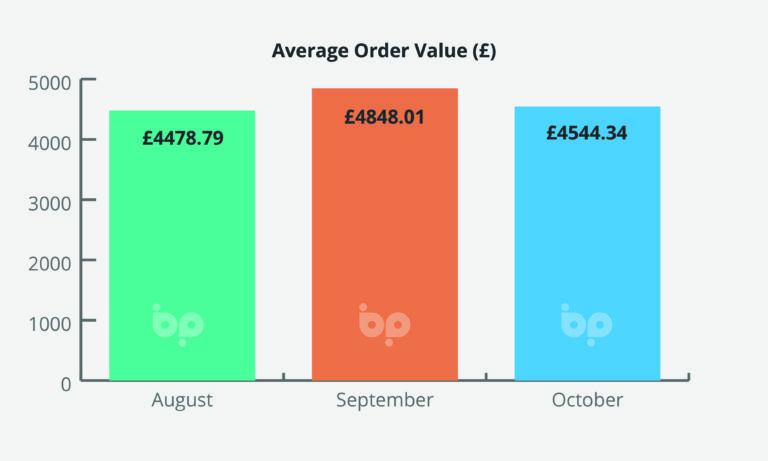

Leads, and sales were up 19% in October on September, more than reversing the falls recorded in September on August, more than offsetting a small drop in average order values (8%) to £4,848.

The industry did good business in October, despite double digit inflation, warnings of an impending downturn in the economy and a projected fall in property prices. So, what’s driving sales, and more importantly, will it continue?

The most important factor are house prices. We know that if people have equity and are confident in the housing market, they are more likely to spend on improving their properties.

At present, and despite the warnings of a drop, year-on-year growth stands at 8.1%. It should be noted, however, that this figure has been inflated by high demand at the start of this year.

13% fewer homes came onto the market in October compared to the five-year average, compounding the imbalance in supply and demand, and keeping house prices higher, even though levels of activity are lower.

The longer-term outlook is that prices will fall. Lloyds Banking Group warning last month, that it expects a drop of around 8% next year as the cost-of-living crisis hits.

The flip side of this, is that one of the major driving forces of inflation, the increased cost of energy, gives homeowners a tangible reason to invest.

Liz Truss had pledged to guarantee that average energy bills at £2,500 a year for two-years. One of the first things her new Chancellor Jeremy Hunt did last month, was to distance the Government from this commitment, trimming the deal to six-months, ahead of an ominous sounding review.

With average bills at £2,500, they remain at more than £1,200 than they were in March this year. Energy market analysts warn a withdrawal of Government funding could push bills as high as £4,684 from April and at best to £3,923 – still £1,423 more than under the current cap.

Tracking Google Trends evidences a very clear correlation between Ofgem announcements on energy costs and interest in new windows and home energy efficiency improvements more broadly

With house prices still historically high homeowners will be more likely to have the confidence to invest in improving the energy efficiency of their properties in the run in to the end of the year at least. Spiralling energy costs, give them the incentive.

Against this backdrop, mining your data for those projects that you didn’t close or win, and re-targeting them, could deliver big results. How many leads went cold earlier in the year, last year? Why?

Business Pilot allows you to bring this information to your fingertips in an instant, helping you to target and re-target prospects, at the same time controlling operational costs and maximising profitability.

The decisions you make today will determine where your business goes in the next 12-months, so if you’re still running your business on unlinked spreadsheets and gut feeling, it’s time to get in touch.