This month’s Business Pilot Barometer was published just days before a General Election, which puts it in a unique position: we have never seen how such an event affects window retail trading figures.

What’s also interesting is that you could be reading this in the days following the General Election (depending on how you consume your trade media) and so you could be mentally extrapolating how the result could affect the Business Pilot Barometer in a month’s time.

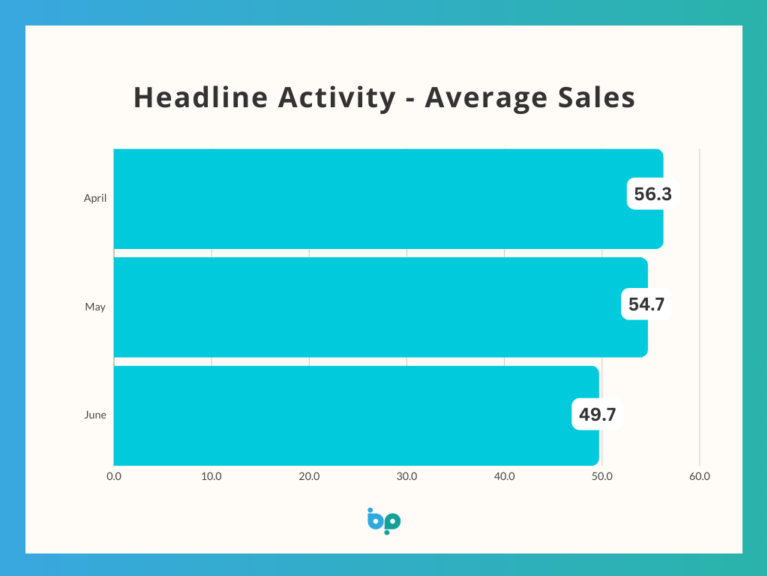

Working with what we do know, average sales are 49.7, which is a 9.1% fall on the previous month (54.7). It is also 12.5% lower than the rolling six-month average of 56.8.

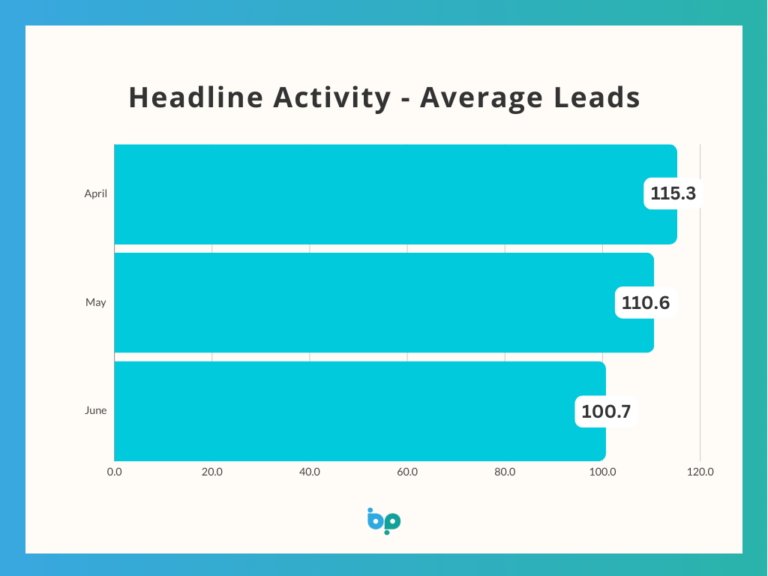

Meanwhile, at 100.7 average leads are 9% lower than May 2024, and 15% lower than the rolling six-month average of 118.5.

With the Euros kicking off a summer of sport (which also includes the Olympics), and families looking to make the most of their holidays following a wet winter, there is a lot of pressure on disposable income, which could explain why those headline figures continue to fall.

But there is also a case to be made for households having a wait-and-see approach to how the next few months take shape.

A General Election is a big upheaval, and while – at the time of writing – many see the result on July 4 to be a foregone conclusion, there are unforeseen variables that could come into play over the next few months which could affect household finances, market confidence, and the economy.

On the morning that this Barometer was written, three high street banks announced mortgage interest rate cuts of up to 0.38%.

This is because economists expect increased buyer activity in the autumn following a likely cut in the Bank of England base rate at the start of August, which has been held at 5.25% since August 2023.

Like the General Election, a reduction in the base rate could be a starting pistol being fired as cautious investors (including homeowners) decide the time is right to resume spending.

Don’t forget that inflation is now officially down to the Bank of England’s target rate of 2%, fuel prices in the UK continue to fall, and the energy price cap fell by 7.2%, further easing pressure on household finances.

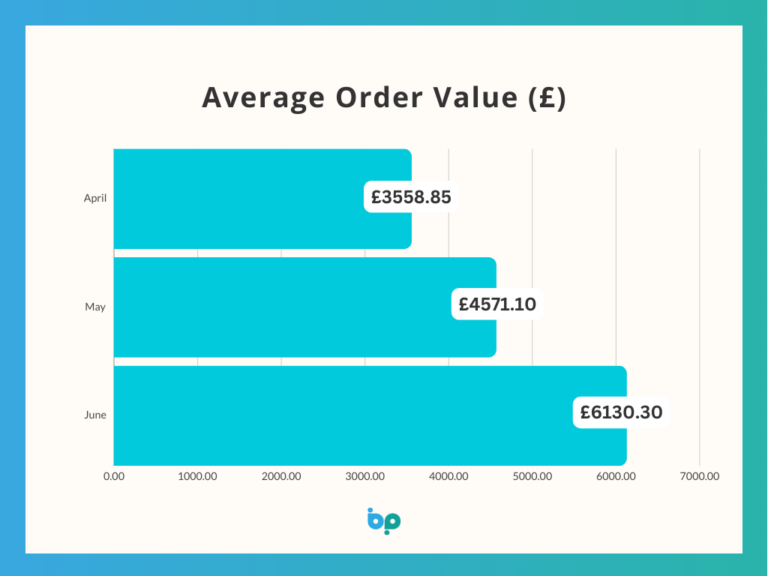

There is some further respite. While the volume market looks like it is waiting for the right moment before picking up again, the average order value continues to increase quite significantly. At £6,130, the average order in June 2024 was 34.1% higher than May 2024 (£4,571). It is also 53.9% higher than the rolling six-month average of £3,984.

This time next month, we’ll have a new government, interest rates could be lower, and we may have won the Euros. Let’s see what effect that’ll have on the Barometer.