At the start of this month [March] £1bn was knocked off the share price of the UK’s quoted housebuilders in a single morning [1/3/23].

It followed Persimmon’s warning that demand for new homes was softening, amid continuing economic uncertainty and pressure on household incomes.

Mortgage approvals in January were also at their lowest level for more than two years, falling to 36,600.

According to lender Nationwide, this contributed to a 0.5% fall in house prices in February compared to January – the sixth month in a row that house prices have fallen.

At £257,406 it said that average house prices are now 1.1% lower than where they were a year ago, representing the biggest annual decline since the end of 2012.

Persimmon’s downbeat analysis of the prospects for new build shouldn’t be ignored. It should, however, also be seen in the context of house builders’ frustration at the closing of the Help to Buy scheme, something which it is lobbying Government to reinstate or replace.

Nonetheless, the same uncertainties – pressure on household incomes and inflation – are also, in the longer term likely to impact the replacement market.

So far, however, there is little sign of a retail slowdown.

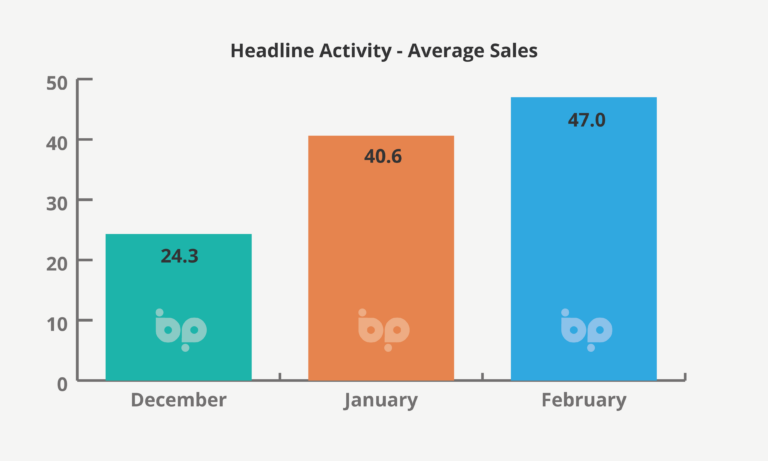

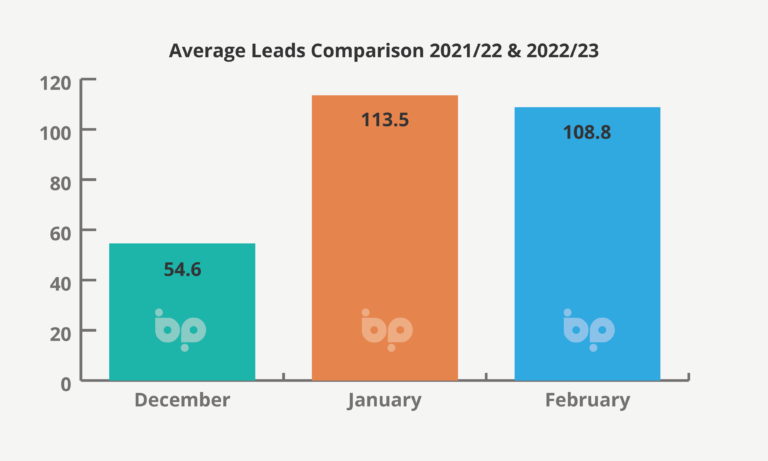

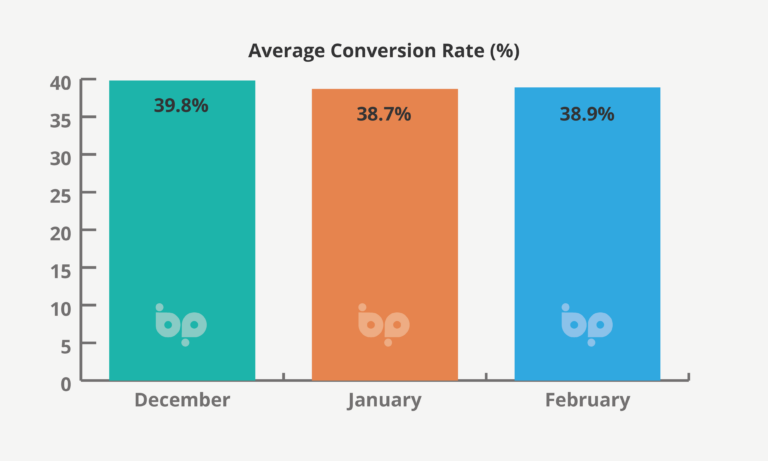

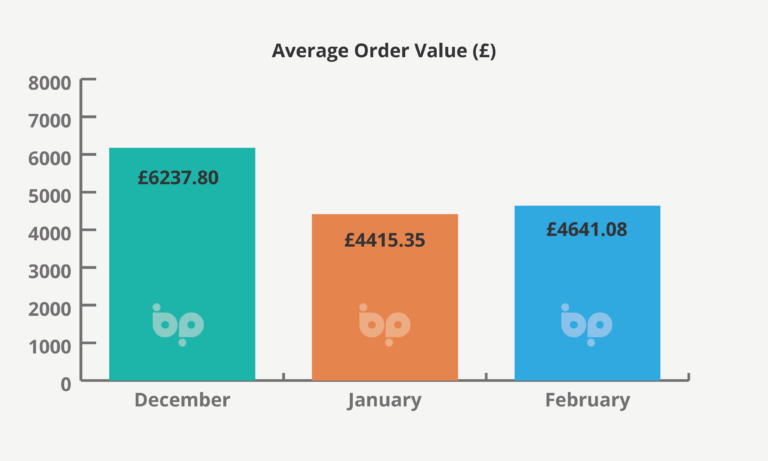

Sales were up 16% in February on January. Leads were marginally down (5%) but this was offset by a 5% increase in average order values.

Year-one-year sales were up 16% in February this year compared to February 2022, a period still in the long tail of the Covid boom in home improvements. Sales were up 6%.

Average order values were down 54% year-on-year, however, February 2022 was something of an anomaly, with recording unusually high demand for and sales of glazed extensions, artificially inflating average order values.

So, in short, people are still spending. We’ve attributed this previously to continuing high energy prices and the drive to insulate. Lower levels of movement in the housing market, have also historically increased activity in the home improvement sector.

It is difficult to see how the retail sector can completely avoid the headwinds impacting new build but it appears that so far least, these have been less cyclonic and more gentle buffeting.

Where we go next will be in part dependent on where energy prices and interest rates go over the next 12-months.

Energy prices remain at record highs. The energy price cap was cut by Ofgem last month from £4,279 to £3,280 based on a fall in wholesale energy prices. However, in reality homeowners will see a rise of around £500 from April because Government support under the Energy Price Guarantee is becoming less generous.

Meanwhile, Andrew Bailey, the Governor of the Bank of England has warned that in the face of still stubbornly high rates of the monetary policy committee could not rule out further interest rate rises when it meets on 23rd of this month [March].

Energy prices in our view will continue to be a major driver of window and door sales this year. Pressure on household incomes may become a barrier to purchase, making availability of finance key in maximising opportunities.

Cost control and effective management of your retail also become key in this context. We make it easy to understand your overheads and operating costs, as well as your profitability – that’s down to profitability on individual products, which supports you in making smart choices about where to go next.