‘We are seeing a slowdown. Average window and door sales in April [2022] dropped 13% on March, while leads dropped by 20%’.

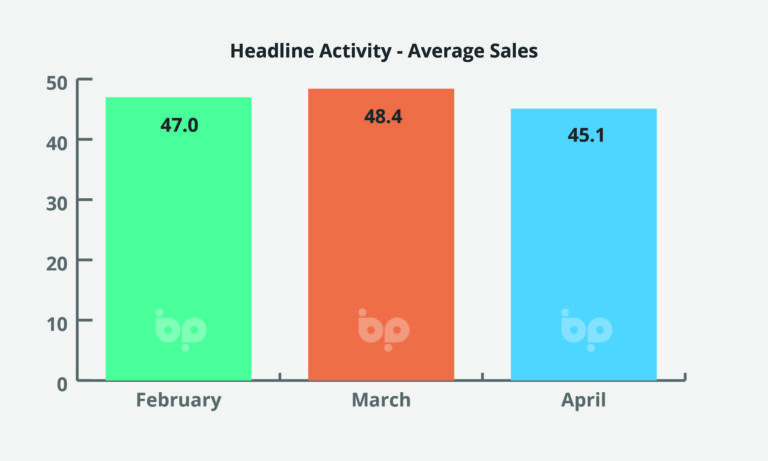

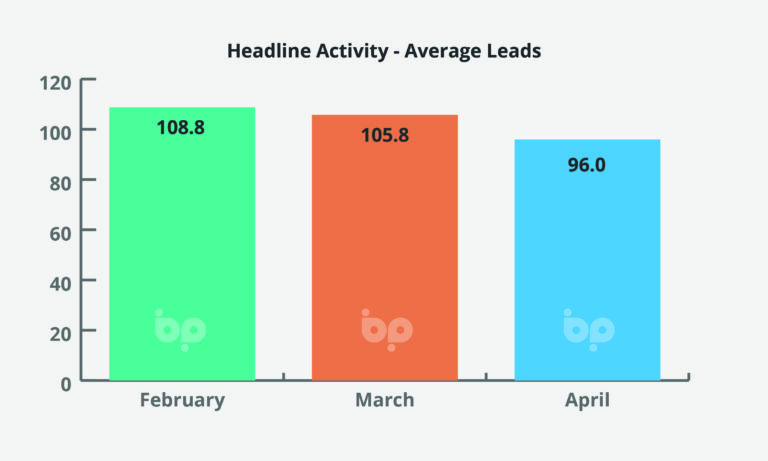

There is a sense of anxiety currently permeating the industry that lower sales last month are an indication that the cost-of-living crisis is finally biting. Average window and sales in April 2023 were down 7%, while leads were down 9%.

Things slowed last month but what is clear from figures for 2022, it doesn’t signal the arrival of a downturn.

Most window and door companies would have been happy with their bottom lines come the close of the financial year. There is no reason – so far – to indicate that they won’t be again, because a lot of the economic conditions remain the same, if not slightly improved.

In fact, despite the fall seen March to April on sales, year-on-year, they’re up 17% April 2023 compared to 2022. Leads are also up year-on-year by a more modest 3%, despite a month-on-month fall March to April of 9%.

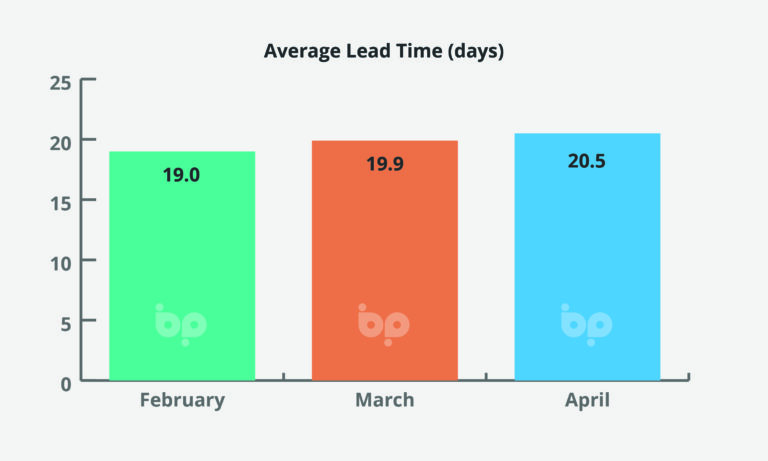

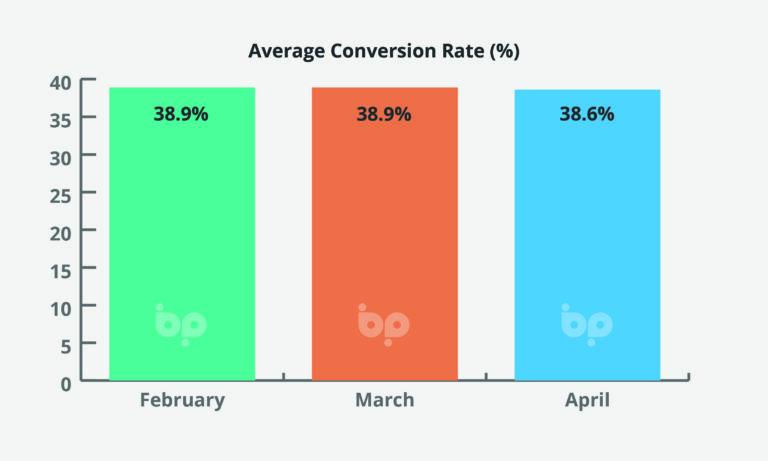

The 9% drop in leads March to April is, however, the figure to track here going forward. Conversion rates have remained at around the 38% mark for the last three months. This would suggest a drop in Sales this month by about the same. This would in theory lead to smaller fabricator order books from late May into June.

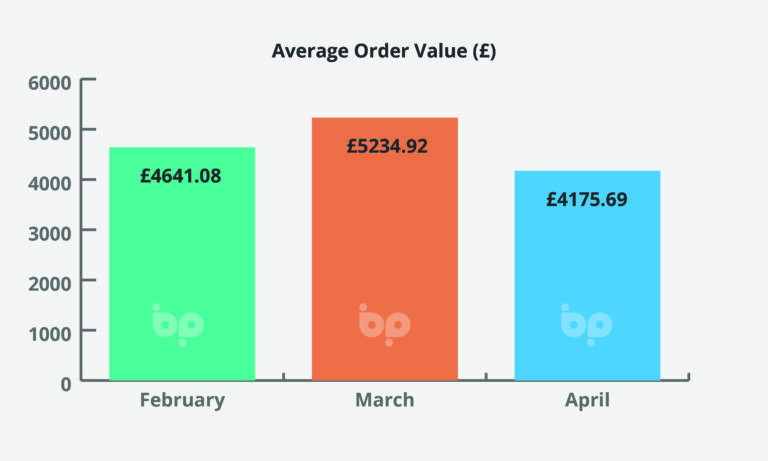

Average order values were down 20% March to April and 24% year-on-year.

Stubbornly high inflation (still at 10.1%) and the cost-of-living crisis, is probably having an impact. That said the closely watched GfK Consumer Confidence Index at the end of last month, found that consumer confidence increased, rising by six points to -30.

Consumers also felt more confident about their personal finances with an eight-point increase to -13, while they were also prepared to spend on big ticket items with the big purchase index at its highest level in a year at -28.

While it isn’t guaranteed that renewed consumer confidence will convert into home improvement spend, it is a prerequisite to it, which is why figures for May, have the potential to exceed expectations.

It is also worth reflecting on the fact that the over 65s are sitting comfortably on a record £2.2 trillion in mortgage-free housing wealth. Close behind them, according to last month’s research by Savills, are owner-occupiers aged 50-64 who hold £1.53 trillion.

These groups may not be immune from inflation, but they are not feeling the same dent in their finances, while still high energy bills and the end of Government subsidies next month [June], give them a very real reason to invest.

There is more of an affordability gap for other socio-economic groups but the incentive to improve the energy efficiency of their home remains, which is why we believe finance is increasingly important in driving conversions, for those not lucky enough to have seen their housing wealth double in a decade!

With a sophisticated lead tracking capability, lead heat mapping and sales pipeline management tool, Business Pilot helps you maximise leads, and support their conversion through strategic data management and analysis.

It also helps you maximise your profitability on every job, through drag and drop installation scheduling and real time financials.